Whether you’re a business owner, an investor, or a financial analyst, understanding the four major components of financial modeling is essential for navigating the complex landscape of finance.

Financial modeling is a critical aspect of strategic decision-making for businesses and individuals alike.

In this article, we will delve into the key components of financial modeling that constitute effective financial modeling, providing insights into its purpose, building blocks, challenges, and real-world applications.

Financial modeling is a powerful tool used across various fields, from investment banking and corporate finance to business planning and entrepreneurship.

It allows users to project a company’s financial performance, assess risks, and make informed decisions.

But what are the core elements that make up a robust financial model?

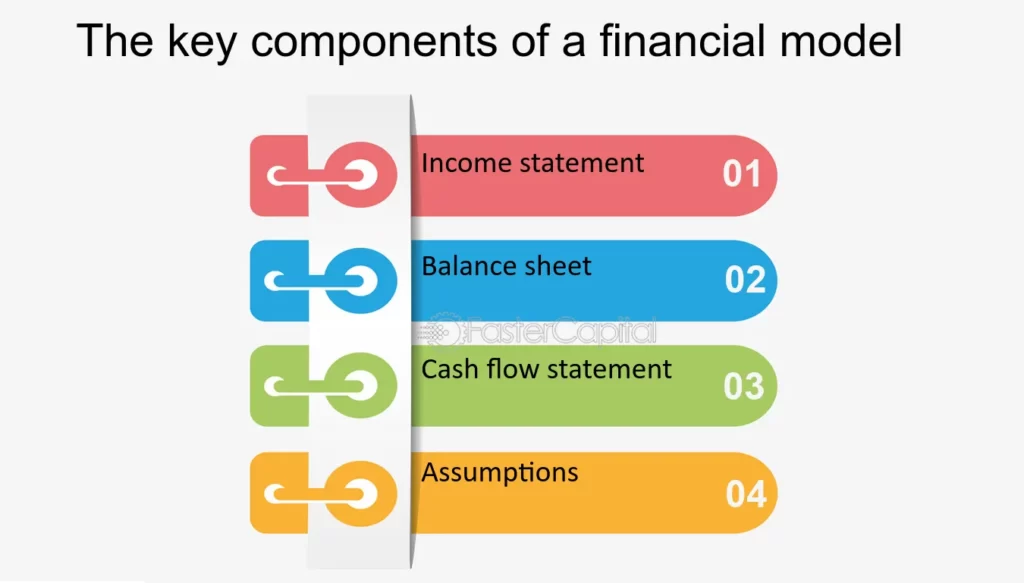

Four major components of financial modeling

1. Income Statement

The income statement, also known as the profit and loss statement, provides a snapshot of a company’s financial health over a specific period.

It summarizes the revenues earned, expenses incurred, and ultimately, the net profit or loss generated. Key components of financial modeling include:

- Revenue: This represents the total income generated from selling goods or services.

- Cost of Goods Sold (COGS): This reflects the direct costs associated with producing the goods or services sold.

- Operating Expenses: These are indirect costs incurred in running the business, such as salaries, rent, and utilities.

- Taxes: This includes corporate income taxes and other applicable levies.

- Net Income: This is the final profit or loss after deducting all expenses from the revenue.

2. Balance Sheet

The balance sheet presents a company’s financial position at a specific point in time.

It captures the company’s assets, liabilities, and shareholders’ equity, providing a picture of its financial resources and obligations.

Key components of financial modeling include:

- Assets: This represents the resources owned by the company, including current assets (cash, inventory) and long-term assets (property, equipment).

- Liabilities: These are the company’s financial obligations, including current liabilities (accounts payable, accrued expenses) and long-term liabilities (loans, bonds).

- Shareholders’ Equity: This represents the residual ownership interest of shareholders, calculated by subtracting liabilities from assets.

3. Cash Flow Statement

The cash flow statement details the inflow and outflow of cash within a specific period. It helps assess the company’s liquidity and ability to meet its financial obligations.

Key components of financial modeling include:

- Operating Activities: This includes cash inflows from sales and outflows for expenses related to running the business.

- Investing Activities: This includes cash inflows from selling assets and outflows for purchasing new assets.

- Financing Activities: This includes cash inflows from raising debt or issuing equity and outflows for repaying debt or paying dividends.

4. Debt Schedule

The debt schedule details the company’s outstanding debt obligations, including the principal amount, interest rate, maturity date, and repayment schedule.

It helps understand the company’s financial risk and ability to manage its debt burden.

These four components of financial modeling are dynamically linked and interdependent. Changes in one component can affect the others, highlighting the interconnectedness of a company’s financial health.

By understanding and analyzing these components, financial models provide valuable insights for decision-making, investment analysis, and strategic planning.

FAQs

What is the significance of financial modeling in startups?

Financial modeling is particularly crucial for startups as it helps in forecasting and planning, aiding them in securing funding and making strategic decisions for sustainable growth.

How often should financial models be updated?

Financial models should be updated regularly, especially when there are significant changes in the business environment, to ensure accuracy and relevance.

Can artificial intelligence replace traditional financial modeling?

While AI can enhance financial modeling, it’s unlikely to replace traditional modeling entirely. Human expertise is still essential for interpreting results and making strategic decisions.

What are the common mistakes to avoid in financial modeling?

Common mistakes include overlooking data quality, neglecting to update assumptions, and failing to consider external factors. Rigorous attention to detail is crucial to avoid these pitfalls.

Are there any free resources for learning financial modeling?

Yes, there are several free resources available online, including tutorials, webinars, and open-access courses, making financial modeling accessible to a broader audience.

Conclusion

In conclusion, mastering the four major components of financial modeling is crucial for individuals and businesses seeking to make informed decisions.

The evolving landscape of finance demands continuous learning and adaptation to leverage the full potential of financial modeling.