Starting a Financial Model For A Green Tech Startup is not just about innovative ideas and cutting-edge technology; it’s also about ensuring financial sustainability.

In the face of climate change and resource depletion, green tech startups are emerging as powerful solutions.

However, turning these innovative ideas into successful businesses requires a solid financial foundation.

A well-crafted financial model is a crucial tool for green tech startups to attract investors, secure funding, and navigate the path to profitability.

As the world pivots towards sustainable solutions, understanding the nuances of green tech becomes crucial for any startup.

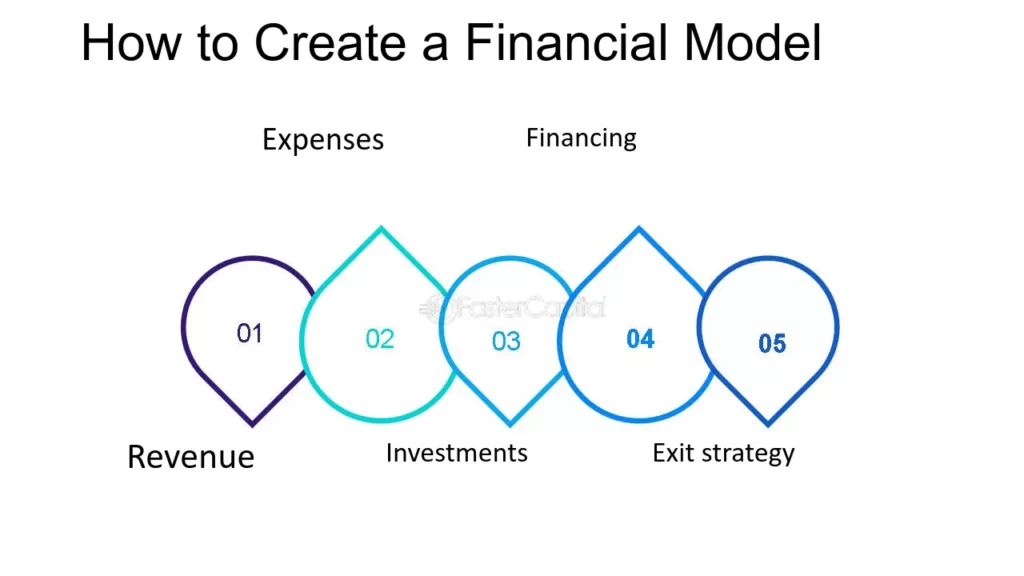

To build a winning Financial Model For A Green Tech Startup

1. Define Your Revenue Model

How will your green tech solution generate revenue? Will it be through product sales, subscriptions, licensing fees, or a combination? Clearly define your revenue streams and forecast future sales based on market research, industry trends, and potential customer adoption.

2. Estimate Cost of Goods Sold (COGS)

Accurately estimate the costs associated with producing and delivering your green tech solution. This includes material costs, manufacturing expenses, and any additional costs specific to your product or service.

3. Project Operating Expenses

Identify and categorize all ongoing expenses associated with running your business, such as salaries, rent, utilities, marketing, and administrative costs. Ensure your projections are realistic and account for potential growth in your operations.

4. Consider Capital Expenditures (CAPEX)

If your green tech solution requires significant upfront investments in equipment, technology, or infrastructure, include these costs in your model. Consider depreciation and amortization schedules for these assets.

5. Plan for Financing

Outline your funding strategy, whether it involves bootstrapping, angel investors, venture capital, or other sources. Define the amount of capital required, potential terms of investment, and repayment plans.

6. Build Your Model

Choose a suitable platform like Excel, Google Sheets, or specialized financial modeling software. Organize your model into clear tabs for each financial statement (income statement, balance sheet, cash flow statement), and include relevant charts and graphs for visual representation.

7. Incorporate Flexibility

Your model should adapt to changing market conditions and unforeseen circumstances. Include sensitivity analyses to assess the impact of different assumptions on your financial projections.

8. Keep it Simple and Clear

While your model should be comprehensive, avoid unnecessary complexity. Prioritize clarity and transparency to allow investors and stakeholders to understand your financial forecasts and assumptions easily.

9. Regularly Review and Update

As your business evolves, so should your financial model. Regularly review and update your projections to reflect changes in your business plan, market dynamics, and financial performance.

10. Seek Expert Support

Consider seeking guidance from financial professionals or experienced advisors familiar with green tech funding and financial modeling. Our expertise can help refine our model and ensure its accuracy and effectiveness.

By following these steps and incorporating these key components, we can build a robust financial model to attract investors, secure funding, and propel our green tech startup toward a sustainable future. Remember, a well-built financial model is not just a static document; it’s a dynamic tool that allows us to assess our business’s potential, make informed decisions, and ultimately achieve success in the green tech landscape. If you want to know about the components of the financial model.

FAQs

What is the significance of a Financial Model For A Green Tech Startup?

Financial Model For A Green Tech Startup provides a roadmap for sustainable growth, balancing profit with environmental impact.

How can a Financial Model For A Green Tech Startup estimate its environmental impact?

Conduct an environmental impact assessment, calculating factors like carbon footprint and sustainable practices.

Are there specialized financial modeling tools for green tech?

Yes, there are tools designed to cater specifically to the unique needs of the Financial Model For A Green Tech Startup.

How do uncertainties in the green tech industry affect financial modeling?

Uncertainties require a flexible Financial Model For A Green Tech Startup, with contingency plans to adapt to changing circumstances.

Can financial models adapt to changing sustainability practices?

Regular updates and revisions ensure that financial models remain aligned with evolving sustainability practices.

Conclusion

Creating a financial model for a green tech startup is a meticulous yet rewarding process.

It’s not just about numbers; it’s about balancing financial success with environmental responsibility. Remember, a well-crafted financial model is a dynamic tool that evolves with your business.