In this article, we’ll delve into the intricacies of financial modeling for fintech startups, offering insights and strategies to help you build a solid foundation for your business.

Financial modeling is the backbone of strategic decision-making for any business, and in the dynamic world of fintech startups, it becomes even more critical.

Financial modeling for a fintech startup involves developing a framework to assess the financial viability and potential growth of the business.

It serves as a tool for entrepreneurs to make informed decisions, secure funding, and communicate their plans to investors. Here’s a step-by-step guide to financial modeling for a fintech startup:

1. Define Clear Objectives and Assumptions

- Objectives: Clearly outline the purpose of the financial model, whether it’s for fundraising, internal planning, or evaluating new business opportunities.

- Assumptions: Identify and document all key assumptions underlying the financial projections, such as market growth rates, customer acquisition costs, and revenue streams.

2. Understand the Fintech Business Model for a Fintech startup

- Revenue Streams: Analyze the various sources of revenue, such as transaction fees, subscription charges, or interest income.

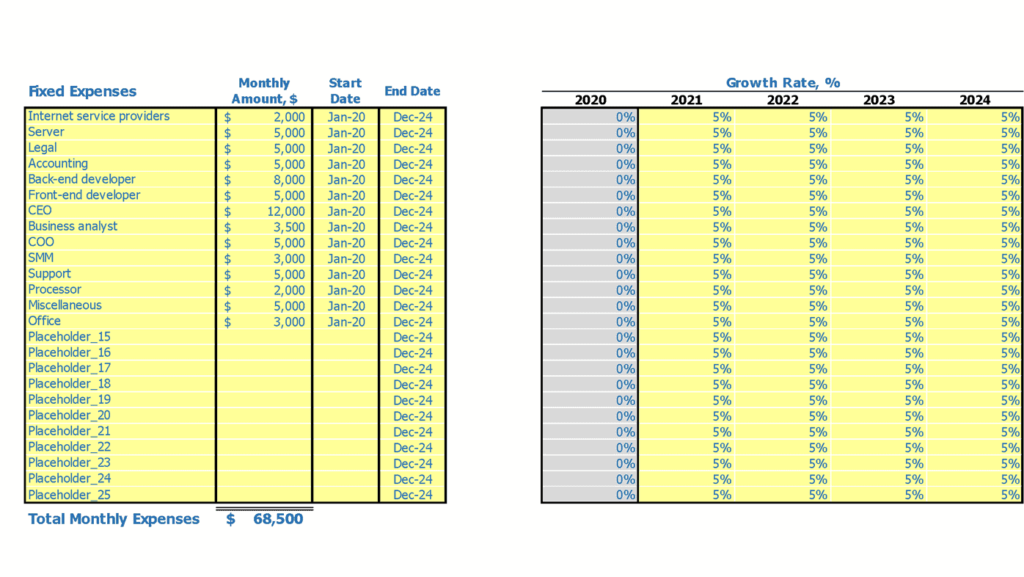

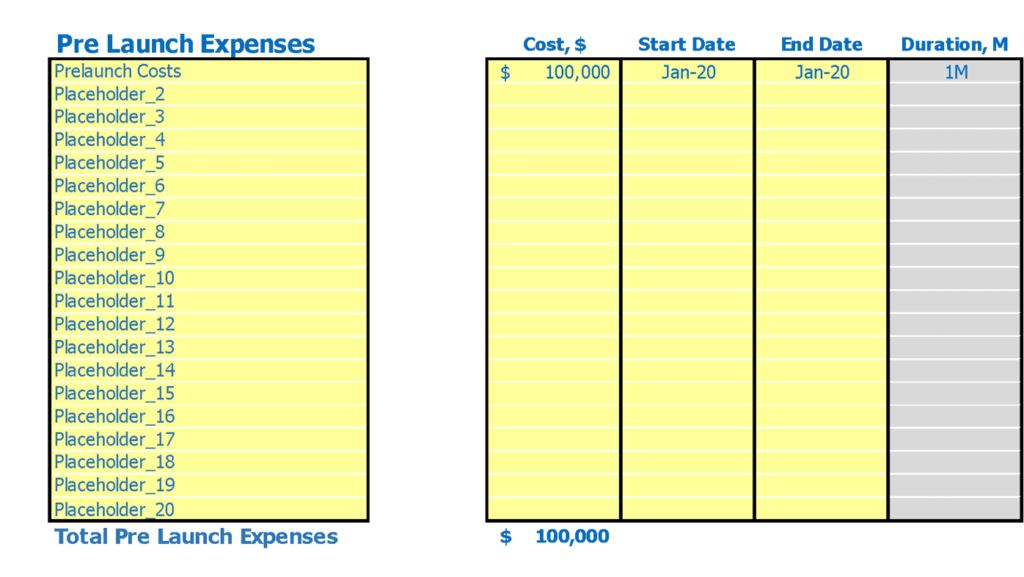

- Cost Structure: Break down the operational expenses, including salaries, marketing costs, technology infrastructure, and regulatory compliance.

- Key Performance Indicators (KPIs): Determine the relevant KPIs for the fintech business, such as customer acquisition cost (CAC), lifetime value (LTV), and gross margin.

3. Develop Financial Statements

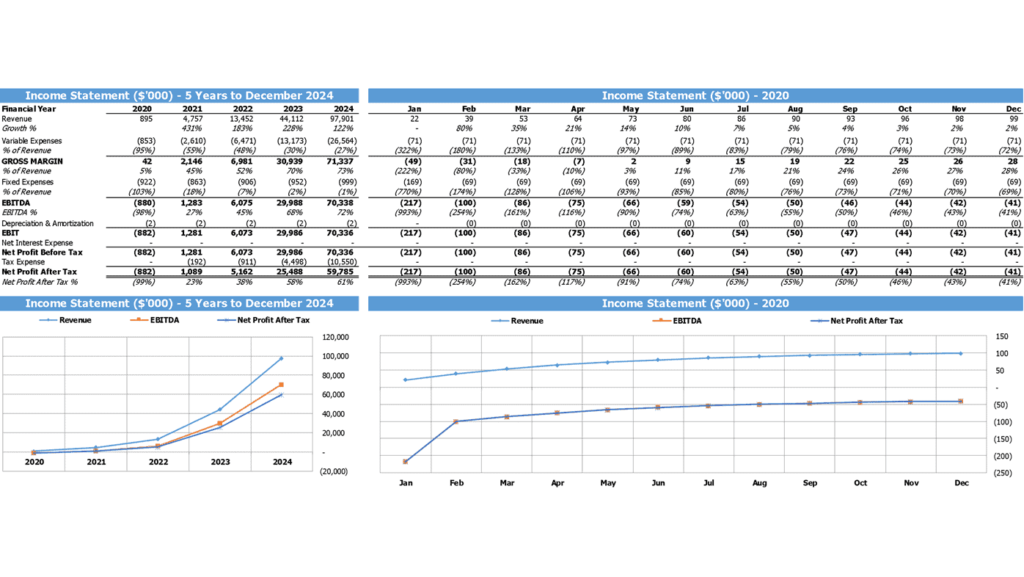

- Income Statement: Project the revenue, expenses, and profit or loss for each period, typically monthly or annually.

- Balance Sheet: Forecast the assets, liabilities, and equity of the company at each financial reporting date.

- Cash Flow Statement: Model the inflows and outflows of cash, including operating cash flow, investing cash flow, and financing cash flow.

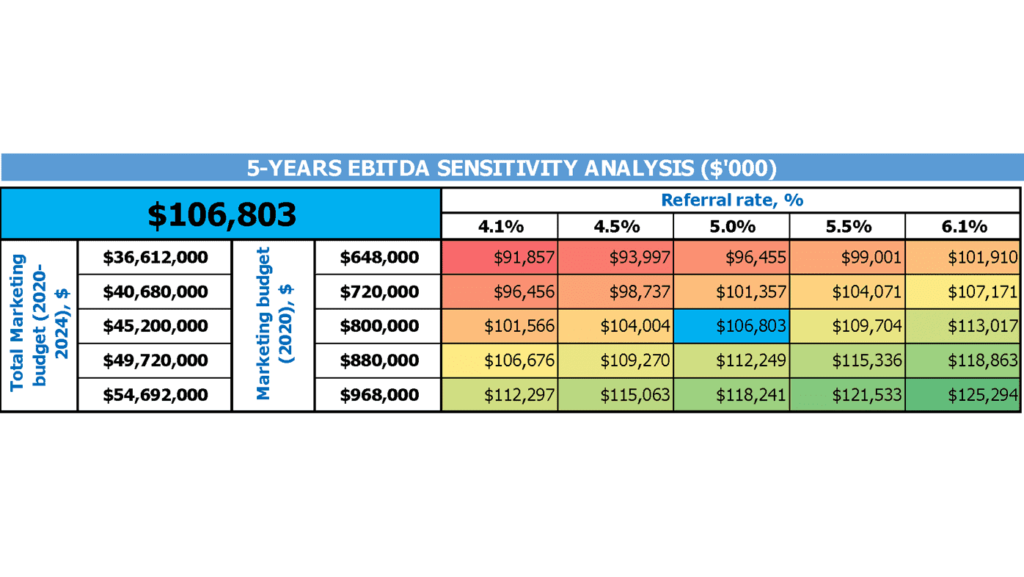

4. Sensitivity Analysis and Scenario Planning

- Sensitivity Analysis: Test the impact of changing key assumptions on the financial projections to assess the model’s robustness.

- Scenario Planning: Develop different scenarios, such as optimistic, pessimistic, and most likely, to consider the range of potential outcomes.

5. Visualize and Communicate Findings

- Charts and Graphs: Create clear and concise charts and graphs to present the financial projections and insights.

- Executive Summary: Prepare a concise executive summary that highlights the key financial findings and implications for the business.

6. Continuously Refine and Update

- Regular Review: Regularly review and update the financial model as market conditions, business strategies, or assumptions change.

- Adaptability: Ensure the financial model can adapt to new business lines, products, or partnerships as the fintech startup evolves.