This article delves into the intricacies of the SaaS 3 statement financial model unraveling its components and illuminating its significance in shaping strategic decisions.

In the dynamic world of Software as a Service (SaaS), financial modeling plays a pivotal role in steering businesses towards success.

Among the array of financial tools, the SaaS 3 statement financial model stands out as a comprehensive framework for evaluating and projecting a SaaS company’s financial health.

The Three Statements Model

The SaaS 3 statement financial model encompasses three fundamental financial statements that collectively portray a holistic picture of a SaaS company’s financial performance:

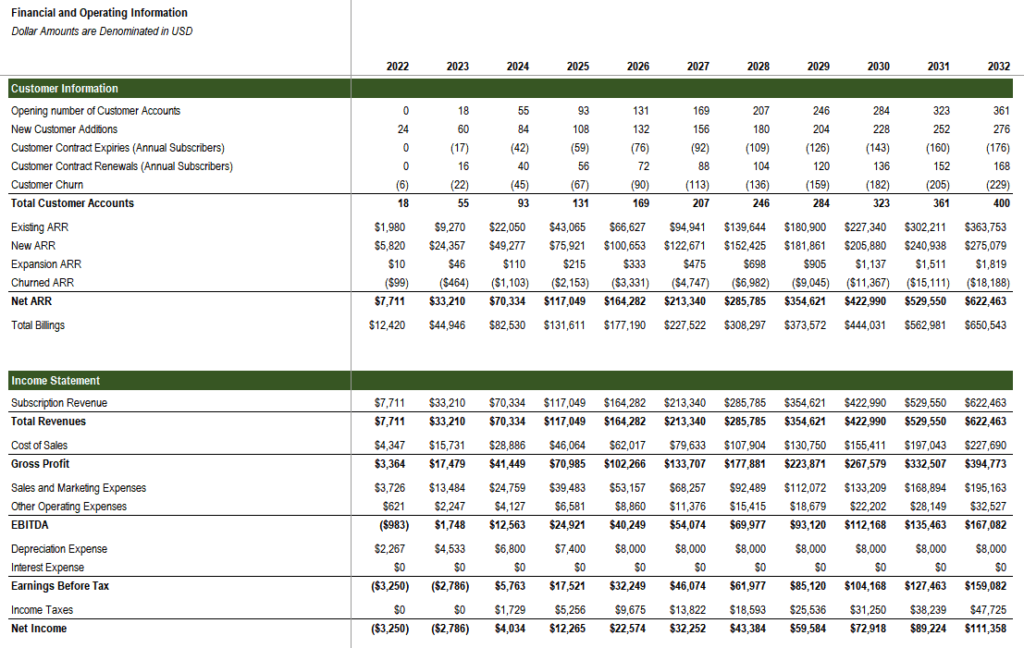

- Income Statement: This statement serves as a scorecard for a company’s operational performance, revealing its ability to generate revenue and manage expenses over a specified period. It depicts the company’s profitability or losses, providing insights into its core business activities.

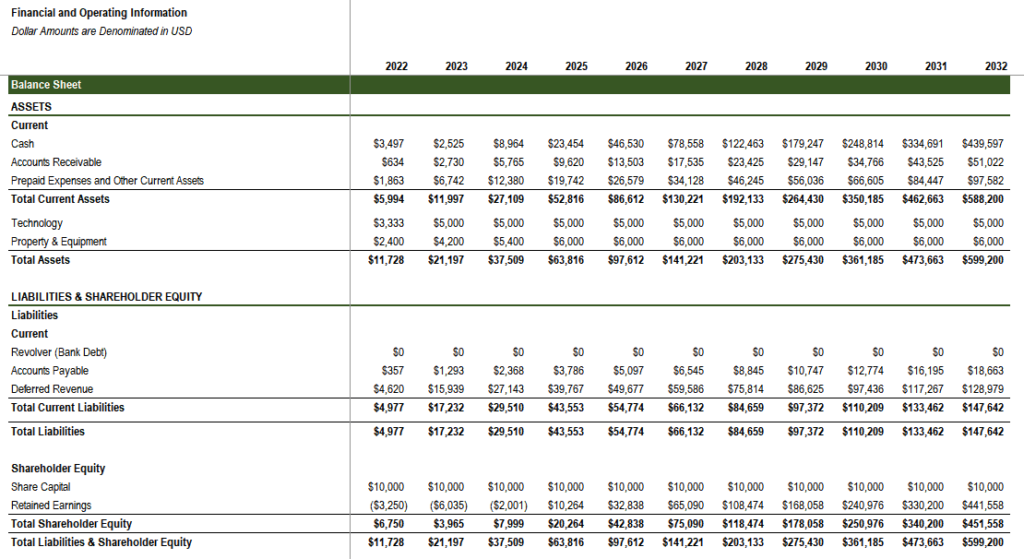

- Balance Sheet: This statement serves as a snapshot of a company’s financial position at a particular point in time. It captures the company’s assets, liabilities, and equity, providing a glimpse into its financial resources and obligations.

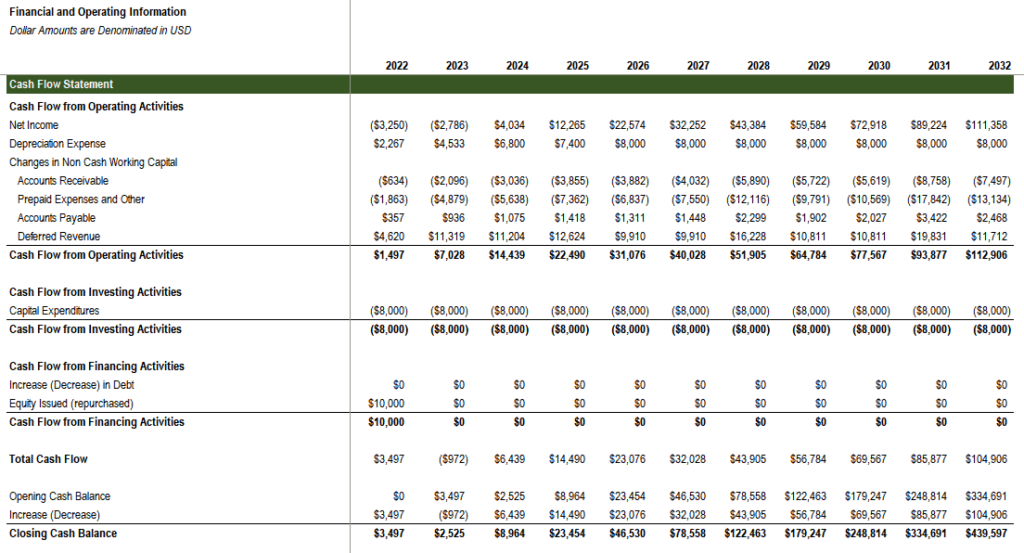

- Cash Flow Statement: This statement bridges the gap between the income and balance sheets, demonstrating how cash flows in and out of the company over a designated period. It tracks the cash movement, highlighting the company’s ability to generate cash from its operations.

Model to the Industry

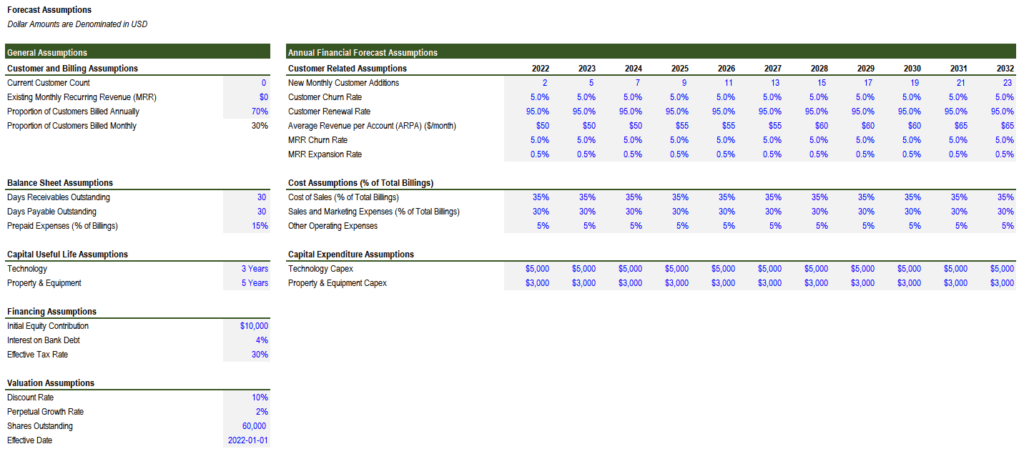

While the SaaS 3 statement financial model forms a universal framework for financial analysis, SaaS companies face unique characteristics that necessitate adaptations to the model.

- Recurring Revenue Model: SaaS businesses typically operate on a subscription-based model, earning recurring revenue from customer contracts. This model necessitates adjustments to revenue recognition and subscription metrics.

- Customer Acquisition Costs (CAC): CAC represents the expense of acquiring new customers, a crucial metric for SaaS companies. Incorporating CAC into the model helps assess the effectiveness of customer acquisition strategies.

- Customer Lifetime Value (CLTV): CLTV represents the total revenue a company expects to generate from a customer over their lifetime. Modeling CLTV provides insights into customer profitability and retention.

Strategic Decisions for SaaS 3 statement financial model

The SaaS 3 statement financial model serves as an invaluable tool for strategic decision-making, empowering businesses to:

- Project Financial Performance: The model allows businesses to forecast future revenue, expenses, and cash flows, enabling informed financial planning and investment decisions.

- Assess Profitability: By analyzing metrics like gross margin, EBITDA, and net income, businesses can gauge their profitability and identify areas for improvement.

- Evaluate Capital Structure: The model provides insights into the company’s debt and equity financing, aiding in optimizing capital structure and managing financial risks.

- Monitor Financial Health: Continuous monitoring of key financial ratios, such as quick and debt-to-equity ratios, helps identify potential financial issues and promptly take corrective measures.