SaaS financial models are forecasting tools that software companies use to project future financial performance.

They are based on historical business performance, market dynamics, and assumptions about future growth.

These assumptions are crucial for understanding the potential financial viability of a SaaS company and for making informed business decisions.

Here are some of the key assumptions that are typically included in a SaaS financial model:

- Customer Acquisition Cost (CAC): The amount of money it costs to acquire a new customer. This includes the costs of marketing, sales, and customer support.

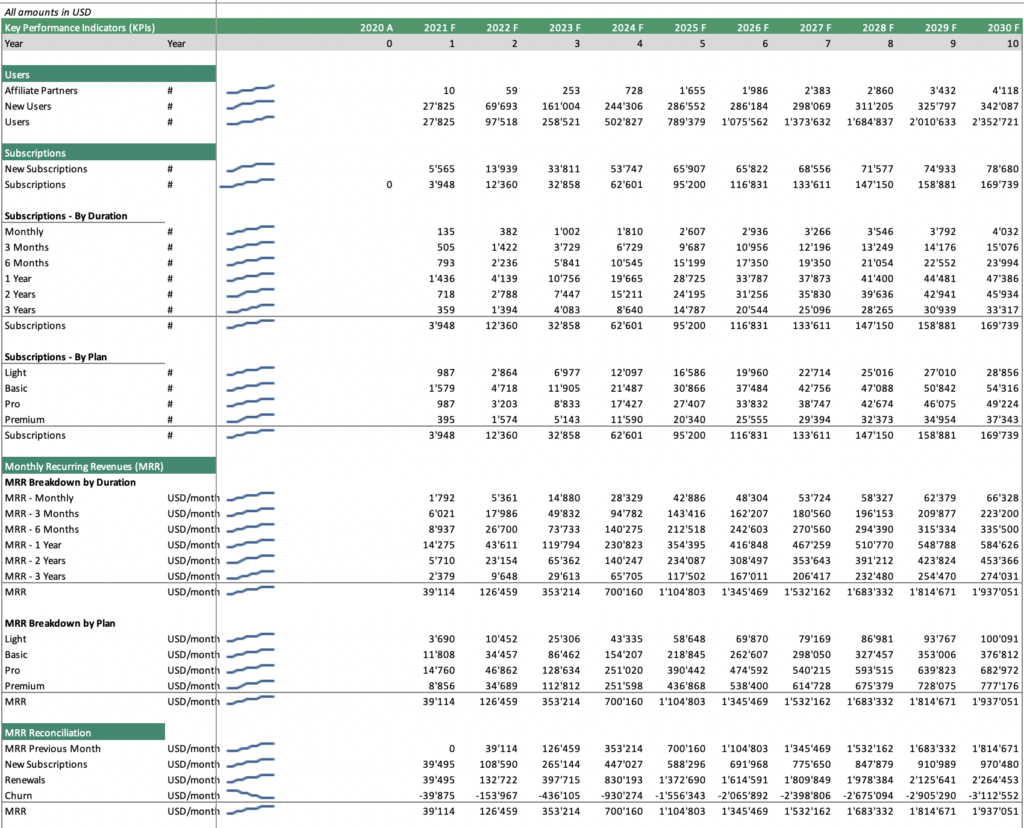

- Customer Lifetime Value (LTV): The total amount of revenue that a customer is expected to generate over their lifetime. This is typically calculated based on the average monthly recurring revenue (MRR) and the average customer churn rate.

- Churn Rate: The percentage of customers who cancel their subscriptions in a given period. This is a critical metric for SaaS companies, as it directly impacts their revenue and profitability.

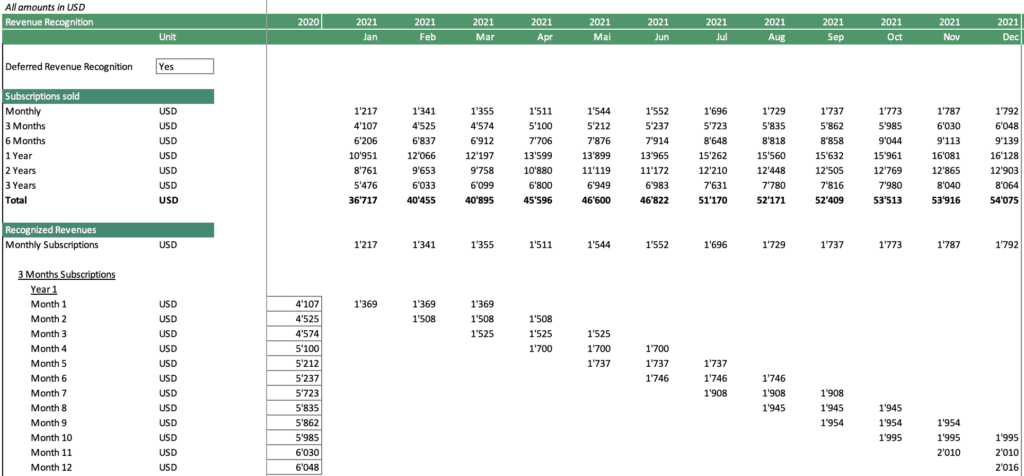

- Monthly Recurring Revenue (MRR): MRR is the predictable and recurring revenue generated by subscriptions on a monthly basis. It assumes that customers will continue to pay their subscriptions regularly.

- Gross Margin: The percentage of revenue that remains after the direct costs of goods sold (COGS) have been subtracted. This metric is an indicator of the company’s ability to generate profit from its products or services.

- Average Revenue Per User (ARPU): ARPU is the average revenue generated per user or customer. It’s important to estimate how much revenue, on average, each customer contributes to the overall business.

- Expansion Revenue: This represents additional revenue generated from existing customers through upselling or cross-selling. SaaS models often assume a certain level of expansion revenue as the customer base grows.

- Sales and Marketing Expenses: Assumptions about the growth of the customer base often involve projections about sales and marketing expenses. This includes advertising, sales team salaries, and other promotional costs.

- Operating Expenses: The costs of running the business, such as salaries, rent, and utilities. These expenses are typically expressed as a percentage of revenue.

- Cash Flow: Assumptions about the timing of cash inflows and outflows are important for understanding the cash flow dynamics of the business. This includes considerations such as payment terms with customers and vendors.

- Investment: The amount of money that the company is planning to invest in growth, such as new product development or marketing.

- Financing: The sources of funding that the company is planning to use, such as venture capital or debt.

The specific assumptions that are used in a SaaS financial model will vary depending on the company and its industry.

It is important to note that the assumptions in a SaaS financial model are just that – assumptions.

They are based on the best available information, but they are not guarantees of future performance.

Actual results may vary depending on a number of factors, including changes in market conditions, competition, and customer behavior.

SaaS financial model companies should regularly review and update their SaaS financial model to reflect changes in their business and in the market.

This will help them to make more informed decisions about their business strategy and to stay on track to achieve their financial goals.