Why is Financial Modeling Important for Startups?

Financial modeling is a crucial element in the journey of financial modeling important for startups. It provides a structured framework for assessing, analyzing, and making informed financial decisions. In this article, we’ll explore the significance of financial modeling for startups and understand why it’s considered an indispensable tool for success.

Introduction

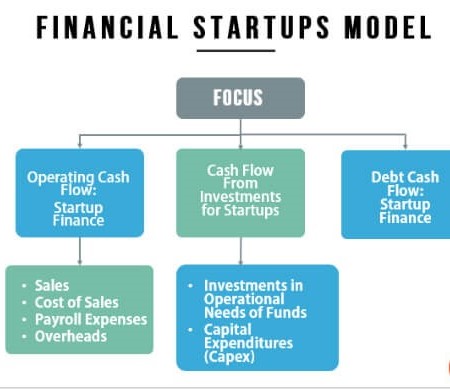

Financial modeling involves creating a comprehensive representation of a company’s financial performance. It encompasses various aspects, including income statements, balance sheets, cash flow projections, and more. financial modeling is important for startups to use these models to simulate their financial future, making it easier to plan and strategize effectively.

Role of Startups

Startups are in a unique position, often working with limited resources and high uncertainty. Financial modeling helps startups navigate these challenges by providing a structured approach to managing their finances.

The Significance of Financial Planning

Effective financial planning is the cornerstone of a successful financial modeling important for startups. Financial models allow entrepreneurs to set realistic goals and allocate resources efficiently. This, in turn, ensures the company’s longevity and growth.

Accuracy in Decision-Making

Financial modeling is important for startups that often face critical decisions regarding investments, expansion, and product development. Financial modeling enables them to make these decisions with confidence, backed by data-driven insights.

Attracting Investors

Investors are more likely to support financial modeling important for startups that can demonstrate a clear and organized financial plan. A well-structured financial model can instill trust and attract potential investors.

Securing Loans and Funding

financial modeling important for startups often requires capital to fuel their growth. Financial models provide a compelling case for lenders and investors, making it easier to secure loans and funding.

Strategic Resource Allocation

Efficient resource allocation is vital for financial modeling important for startups. Financial modeling helps in identifying areas that need investment and those that can be trimmed, optimizing resource utilization.

Risk Mitigation

financial modeling is important for startups that face a higher degree of risk. Financial models allow for scenario analysis, helping to prepare for unexpected challenges and mitigate potential risks.

Business Growth and Scaling

Financial modeling is important for startups that intend to scale and need to understand how their financials will evolve. Financial modeling provides insights into the financial requirements of growth.

Assessing Viability and Sustainability

Financial modeling important for startup ideas financially viable in the long run? Financial models answer this question, helping entrepreneurs assess the sustainability of their business model.

Building Credibility

Startups need to build credibility with stakeholders, including customers, suppliers, and partners. Accurate financial modeling enhances a startup’s reputation and reliability.

Benchmarking and Performance Tracking

Financial models act as benchmarks for performance. Startups can compare actual financial results with their projections, making it easier to identify areas that require improvement.

Adaptability and Flexibility

financial modeling is important for startups that often need to pivot or adapt to changing market conditions. Financial models can be adjusted to reflect these changes, ensuring the business remains agile.

Compliance and Regulation

financial modeling is important for startups that need to adhere to financial regulations and tax requirements. Financial models help in ensuring compliance and avoiding legal issues.

The Key to Startup Success

In conclusion, financial modeling is important for startups and is the key to financial modeling important for startups’ success. It empowers entrepreneurs with the tools and insights needed to navigate the complexities of business in its initial stages. By providing accurate financial projections and a roadmap for resource allocation, financial modeling is important for startups can confidently pursue their goals and aspirations.

What software can I use for financial modeling as a startup?

There are several software options available, including Microsoft Excel, Google Sheets, and specialized financial modeling tools like QuickBooks and Quicken.

How frequently should I update my financial model as a startup?

It’s advisable to update your financial model regularly, especially when significant changes occur in your business, such as a new round of funding, a major pivot, or substantial growth.

Can financial modeling help me secure venture capital funding?

Yes, a well-constructed financial model can significantly increase your chances of attracting venture capital funding. It demonstrates your business acumen and commitment to financial planning.

Are there professional services that can assist startups with financial modeling?

Yes, many financial consultants and advisory firms specialize in helping financial modeling important for startups with financial modeling, ensuring accuracy and compliance.

How do I learn to create effective financial models for my startup?

You can find various online courses and resources that provide guidance on creating effective financial models. Additionally, consider hiring a financial expert or consultant to assist you in the process.