When it comes to managing finances for your e-commerce business, having a clear and organized system is crucial. One essential tool for maintaining financial records is a chart of accounts. In this article, we will explore what a chart of accounts is, why it is important for e-commerce sellers, and how to create one that suits your business needs.

What is a Chart of Accounts?

A chart of accounts is a systematic listing of all the financial accounts used by a business. It provides a comprehensive overview of the company’s financial transactions and helps organize and categorize them into different account types. Each account in the chart of accounts is assigned a unique number or code, making it easier to track and analyze financial information.

Chart of accounts for e-commerce business?

In the realm of e-commerce, a chart of accounts is the financial compass that guides businesses through the complex landscape of online retail. It’s the backbone of financial management, providing a systematic structure to categorize and track all monetary transactions. This essential tool not only ensures that revenues and expenses are recorded accurately but also offers invaluable insights into the financial health of an e-commerce venture.

From managing inventory and shipping costs to analyzing the effectiveness of advertising campaigns, a well-organized chart of accounts is the linchpin that empowers e-commerce entrepreneurs to make informed decisions, optimize their operations, and navigate the often turbulent waters of online business with confidence.

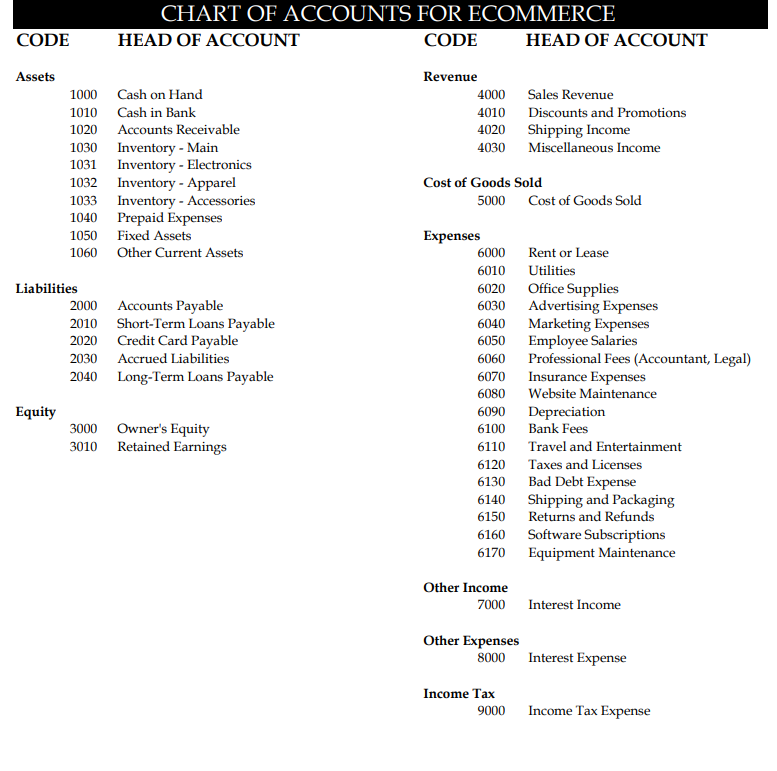

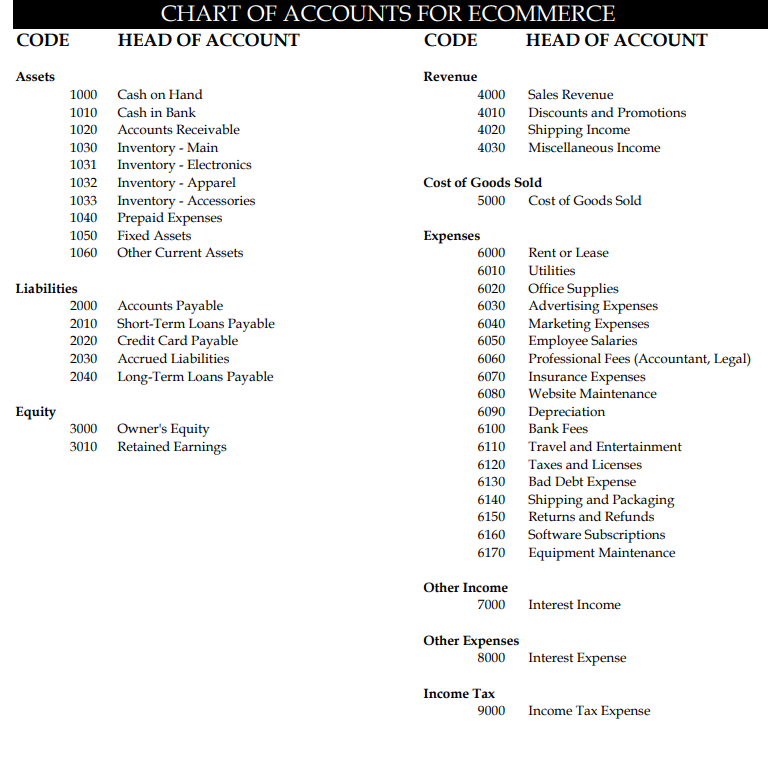

Sample chart of accounts for e-commerce business

Here’s a sample chart of accounts with account codes for an e-commerce business. Keep in mind that the specific account codes may vary depending on your accounting software and preferences, but this should give you a good starting point.

The Importance of a Chart of Accounts for E-commerce Sellers

A well-designed chart of accounts is essential for e-commerce sellers for several reasons:

Accurate Financial Reporting: By categorizing transactions into specific accounts, a chart of accounts ensures that financial reports accurately reflect the financial health of the business. It allows sellers to track revenue, expenses, and other important metrics.

Effective Decision Making: With a properly structured chart of accounts, e-commerce sellers can easily access and analyze financial data. This information is crucial for making informed decisions regarding pricing strategies, inventory management, marketing campaigns, and more.

Tax Compliance: A chart of accounts helps e-commerce sellers keep track of taxable income, deductible expenses, and other financial information required for tax reporting. It simplifies the tax filing process and reduces the risk of errors or omissions.

Chart of accounts for e-commerce company

Key Elements of a Chart of Accounts

A chart of accounts typically consists of five main elements:

Assets

Assets represent the resources owned by a business. For e-commerce sellers, assets can include inventory, cash, accounts receivable, and fixed assets like equipment or property. Each asset account should be labeled and assigned a unique account number for easy identification.

Liabilities

Liabilities are the debts and obligations owed by a business. This can include accounts payable, loans, credit card balances, and other outstanding liabilities. Properly tracking liabilities helps e-commerce sellers understand their financial obligations and plan for repayment.

Equity

Equity represents the owner’s or shareholders’ interest in the business. It includes initial investments, retained earnings, and any additional capital contributions. Equity accounts help measure the overall value of the e-commerce business.

Revenue

Revenue accounts track the income generated from the sale of products or services. For e-commerce sellers, revenue accounts can include sales revenue, shipping income, or revenue from other sources like advertising or affiliate programs. Accurately categorizing revenue allows sellers to analyze sales performance and identify areas for improvement.

Expenses

Expense accounts track the costs incurred in running an e-commerce business. This includes expenses such as the cost of goods sold, marketing expenses, shipping costs, utilities, employee salaries, and other operational expenses. Properly categorizing expenses helps sellers monitor spending and identify areas where costs can be reduced.

How to set up a chart of accounts for Your E-commerce Business?

When designing a chart of accounts for your e-commerce business, it is important to consider the specific needs and characteristics of your operation. Here are some steps to help you create an effective chart of accounts:

Identify Account Categories: Determine the main account categories relevant to your business, such as assets, liabilities, equity, revenue, and expenses. This will serve as the foundation for your chart of accounts.

Create Account Codes: Assign unique codes or numbers to each account to facilitate easy organization and identification.

Consider Sub-Accounts: If your e-commerce business has complex operations or multiple product lines, consider using sub-accounts to provide more detailed tracking and analysis. Sub-accounts can be used to break down revenue or expenses by specific product categories, sales channels, or geographical regions.

Consult Accounting Professionals: If you’re uncertain about the best way to structure your chart of accounts, it’s advisable to seek guidance from accounting professionals who specialize in e-commerce businesses. They can provide valuable insights and ensure compliance with accounting standards.

How many categories are in a chart of accounts?

A chart of accounts typically consists of five main categories or account types. These categories are used to organize and classify financial transactions in an accounting system. The five main categories are:

- Assets: This category includes all the resources and items of value that a business owns. It’s typically divided into current assets (those expected to be converted into cash or used up within one year) and non-current assets (those with a longer lifespan).

- Liabilities: Liabilities represent the debts and obligations that a business owes to external parties. Like assets, liabilities are also often divided into current liabilities (due within one year) and non-current liabilities (due beyond one year).

- Equity: Equity, also known as owner’s equity or shareholders’ equity, represents the ownership interest in the business. It’s the residual interest in the assets after deducting liabilities. Equity accounts include common stock, retained earnings, and additional paid-in capital.

- Revenue: Revenue accounts track the income generated by the business from its primary operations. These accounts include sales revenue, service revenue, interest income, and any other income earned by the company.

- Expenses: Expense accounts represent the costs incurred by the business in order to generate revenue. These accounts include items such as salaries and wages, rent, utilities, office supplies, and other operating expenses.

Can a business use a class to track account balances?

Yes, a business can use classes or cost centers to track account balances within its accounting system. This is a common practice in accounting and financial management, especially for businesses that want to analyze and report financial data for different segments or divisions of the company.

How it works:

Classes or Cost Centers: Classes, sometimes called cost centers or departments, are used to categorize transactions within an organization. For example, a business might have separate classes for different product lines, geographical locations, projects, or divisions. Each class represents a distinct category or segment of the business.

Tracking Transactions: When recording financial transactions, businesses can assign a class to each transaction. This class designation allows them to associate the transaction with a specific category or segment of the business. For example, if a company has two product lines, it can assign a class to each sale to indicate which product line generated the revenue.

Reporting and Analysis: By using classes, a business can generate financial reports that provide insights into the performance and financial health of different segments or categories. This can be valuable for assessing the profitability of specific product lines, measuring the success of projects, or evaluating the financial performance of different branches or divisions.

Budgeting and Planning: Classes are also helpful for budgeting and planning. Businesses can create separate budgets for each class or cost center, allowing them to set specific financial goals and allocate resources accordingly.

Tax and Compliance Reporting: In some cases, businesses may use classes for tax and compliance purposes. For example, they might need to track revenue and expenses separately for different tax jurisdictions or legal entities.

Using classes to track account balances can provide a more granular view of a business’s financial data and help management make informed decisions about resource allocation, strategy, and performance improvement.

How do I start using Patriot’s accounting software?

To streamline your financial management processes, consider integrating your chart of accounts with accounting software designed for e-commerce businesses. These software solutions often come with built-in templates and tools that facilitate the creation and maintenance of a chart of accounts. By automating data entry and report generation, accounting software can save time and reduce the risk of manual errors in financial record-keeping.

Regularly Reviewing and Updating Your Chart of Accounts

As your e-commerce business evolves and grows, it is essential to periodically review and update your chart of accounts. Regularly assess whether the existing accounts are still relevant, make adjustments to accommodate new revenue streams or expenses, and ensure that your chart of accounts aligns with your business goals and reporting requirements.

Can I use a standard chart of accounts for my e-commerce business?

While there are general guidelines for structuring a chart of accounts, it’s recommended to tailor it to your specific e-commerce business needs. This ensures that your accounts accurately reflect your operations and facilitate meaningful financial analysis.

How often should I review and update my chart of accounts?

It’s advisable to review your chart of accounts annually or whenever significant changes occur in your e-commerce business. Regularly updating your accounts ensures that they remain relevant and provide accurate financial insights.

Do I need accounting software to maintain a chart of accounts?

While not mandatory, accounting software can greatly simplify the process of maintaining and managing your chart of accounts. It automates data entry, generates financial reports, and provides real-time insights into your business’s financial performance.

Can I add new accounts to my chart of accounts as my business grows?

Yes, you can add new accounts to your chart of accounts as your e-commerce business expands. It’s important to maintain consistency in account naming and numbering to ensure clarity and avoid confusion.

How can a well-designed chart of accounts benefit my e-commerce business?

A well-designed chart of accounts provides a clear and organized system for tracking financial transactions, facilitating accurate financial reporting, informed decision-making, and tax compliance. It allows you to analyze revenue, expenses, assets, liabilities, and equity, gaining valuable insights into your business’s financial health and performance.