Bookkeeping in Construction refers to the systematic recording, organizing, and managing of financial transactions and records within a construction company. It involves tracking and documenting income, expenses, assets, liabilities, and equity related to construction projects. By maintaining accurate financial records, construction companies can gain insights into their financial health, profitability, and project performance.

Importance of Bookkeeping in Construction

Effective bookkeeping is essential for construction companies due to the unique nature of the industry. Construction projects involve numerous financial transactions, including material purchases, subcontractor payments, equipment rentals, and labor costs. Proper bookkeeping ensures that all these transactions are recorded accurately, enabling companies to monitor costs, maintain cash flow, and comply with financial regulations.

Key Principles of Construction Bookkeeping

To maintain accurate and reliable financial records, Bookkeeping in Construction follows several key principles:

Accrual Accounting

Accrual accounting is widely used in Bookkeeping in Construction. It recognizes revenues and expenses when they are earned or incurred, regardless of when the cash is received or paid. This method provides a more accurate representation of a company’s financial position and performance.

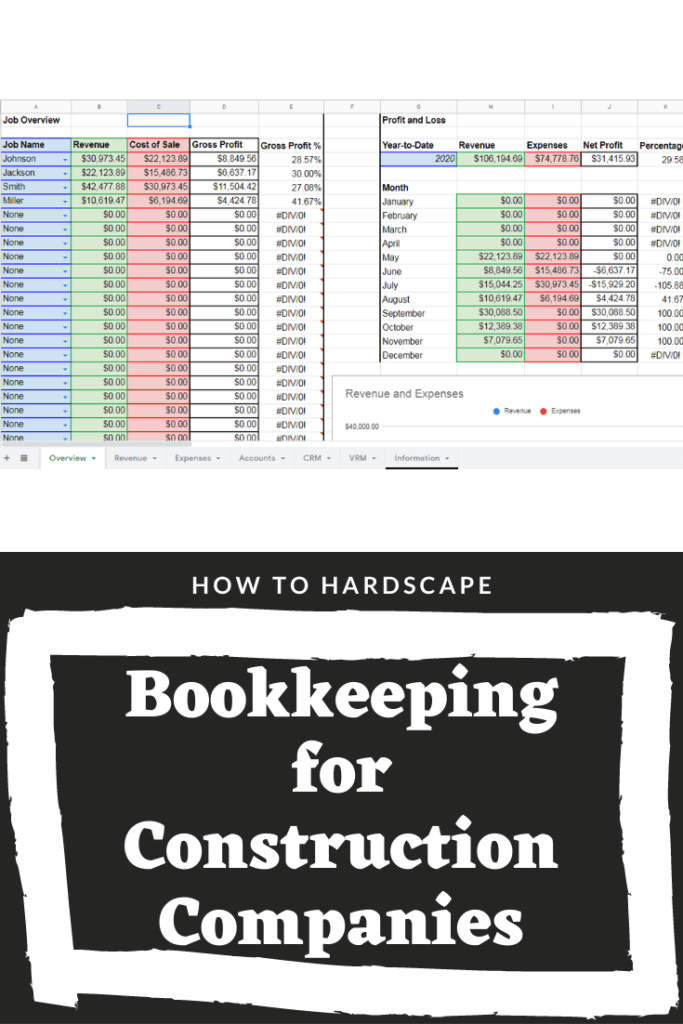

Cost Tracking and Job Costing

Bookkeeping in Construction projects often has multiple cost elements. Effective bookkeeping involves tracking and allocating costs to specific projects or job sites. Job costing enables companies to monitor the profitability of individual projects and make informed decisions.

Separate Accounts for Each Project

To ensure proper project cost tracking and financial clarity, construction companies typically maintain separate accounts for each project. This segregation helps prevent the intermingling of funds and provides a clear overview of project-specific financials.

How do I choose the right bookkeeping software for my construction business?

To establish effective bookkeeping practices in the construction industry, consider the following best practices:

Regular Reconciliation

Perform regular bank reconciliations to ensure that financial records match with bank statements. This practice helps identify discrepancies and ensures accurate financial reporting.

Documenting and Categorizing Expenses

Maintain a well-organized system for documenting and categorizing expenses related to construction projects. This practice enables easy tracking of project costs and simplifies financial analysis.

Retaining Supporting Documentation

Keep all supporting documentation, such as invoices, receipts, and contracts, organized and easily accessible. These documents serve as evidence for transactions and provide necessary backup during audits or disputes.

Implementing Internal Controls

Establish robust internal controls to minimize the risk of fraud or errors. Segregate duties, implement approval processes, and regularly review financial records to maintain integrity and accuracy.

Do you need a bookkeeper for a construction business?

Selecting the appropriate bookkeeping software is vital for efficient construction bookkeeping. Look for software that offers features specifically designed for the construction industry, such as project tracking, job costing, and integration with other construction management systems.

What are the most common bookkeeping challenges faced by the Bookkeeping in Construction Industry?

Bookkeeping in the construction industry comes with its own set of challenges, including:

Tracking Costs Across Multiple Projects

Managing and tracking costs across multiple ongoing projects can be complex. Bookkeeping in Construction must provide accurate and detailed cost tracking to ensure project profitability.

Dealing with Change Orders and Variations

Bookkeeping in Construction projects often experiences change orders and variations that impact costs and revenue. Bookkeeping practices should account for these changes to maintain accurate financial records.

Managing Cash Flow

Cash flow management is critical in construction due to the timing of payments and expenses. Bookkeeping in Construction should focus on monitoring cash flow and ensuring sufficient funds for project operations.

What are the benefits of outsourcing Bookkeeping Services for Construction Companies?

Outsourcing bookkeeping services to specialized professionals can offer several advantages for construction companies, including:

Expertise and Industry Knowledge

Outsourced bookkeepers possess specialized knowledge of Bookkeeping in Construction practices and regulations, ensuring accurate and compliant financial reporting.

Time and Cost Savings

By outsourcing bookkeeping, construction companies can free up valuable time and resources, allowing them to focus on core business activities and reducing overhead costs.

Access to Advanced Technology

Outsourced bookkeeping services often utilize advanced accounting software and tools, providing construction companies with access to the latest technology without significant investments.

What accounting components affect the construction industry’s bookkeeping process?

Construction companies must comply with various financial regulations and reporting requirements. These may include tax obligations, labor regulations, and industry-specific regulations. Adhering to these regulations is essential for avoiding penalties and maintaining the company’s financial reputation.

Monitoring and Analyzing Financial Performance in Construction

Bookkeeping in Construction facilitates monitoring and analyzing financial performance by generating financial reports, including income statements, balance sheets, and cash flow statements. These reports help construction companies assess their profitability, identify areas for improvement, and make informed financial decisions.

Integrating Bookkeeping with Project Management in Construction

Integrating bookkeeping with project management systems enhances efficiency and accuracy in the construction industry. By integrating project data with bookkeeping records, companies can better track costs, manage budgets, and ensure project profitability.

Why is cash flow management important in construction?

Cash flow management is vital for construction companies to ensure uninterrupted project operations. Effective bookkeeping practices help monitor cash inflows and outflows, enabling timely payment of expenses and maximizing revenue generation.

Tax Considerations for Construction Companies

Construction companies must navigate various tax considerations, such as income tax, sales tax, and payroll tax. Adhering to tax regulations, maintaining proper records, and working with tax professionals can help companies optimize their tax positions and minimize potential liabilities.

Bookkeeping Tools and Resources for Construction Professionals

Several bookkeeping tools and resources are available to assist construction professionals in their financial management efforts. These tools offer features like expense tracking, invoicing, and financial reporting, streamlining bookkeeping processes for construction companies.

Key Takeaways and Conclusion

Bookkeeping is a vital aspect of construction management, ensuring accurate financial recording, cost tracking, and compliance with regulations. By implementing sound bookkeeping practices and utilizing appropriate software and resources, construction companies can optimize their financial operations, make informed decisions, and achieve long-term success.

Why is bookkeeping important in the construction industry?

Bookkeeping in Construction is important in the construction industry to track expenses, manage cash flow, and ensure compliance with financial regulations. It helps construction companies maintain accurate financial records and make informed business decisions.

How does bookkeeping benefit construction companies?

Bookkeeping benefits construction companies by providing financial accuracy, cost tracking, and insights into project profitability. It helps companies manage their finances effectively and make informed decisions.

Can construction companies outsource their bookkeeping services?

Yes, construction companies can outsource their bookkeeping services to specialized professionals. Outsourcing offers expertise, cost savings, and access to advanced technology, allowing companies to focus on their core business activities.

What are the key challenges in construction bookkeeping?

Some key challenges in construction bookkeeping include tracking costs across multiple projects, managing change orders and variations, and effectively managing cash flow due to timing differences in payments and expenses.

How does bookkeeping integrate with project management in construction?

Integrating bookkeeping with project management systems enhances efficiency and accuracy in the construction industry. It allows for better cost tracking, budget management, and project profitability analysis.