The Income (P&L) Statement is a critical financial tool that provides a snapshot of your business’s financial health. E-commerce businesses operate in a dynamic and competitive landscape. To thrive, you need to stay on top of your financial performance. Let’s delve deeper into what it is and why it matters for your e-commerce venture.

What’s on the income statement (profit and loss)?

The Income Statement, also known as the Profit and Loss (P&L) statement, is a financial report that summarizes your business’s revenues, costs, and expenses during a specific period. It is typically prepared on a monthly, quarterly, or annual basis, allowing you to track your financial performance over time.

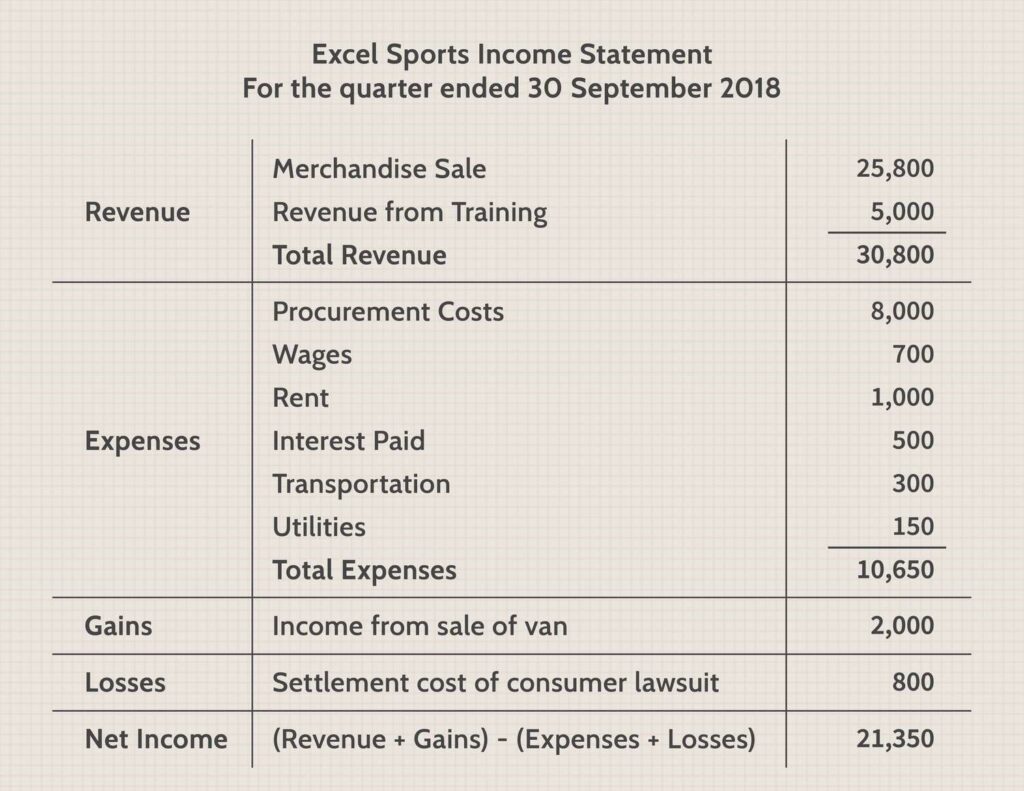

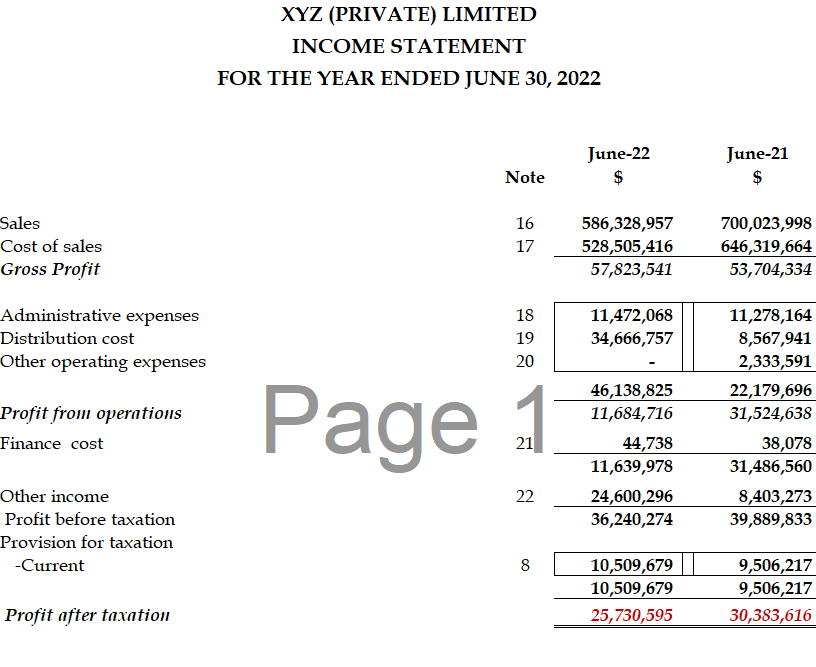

Profit and Loss (P&L) typically includes the following components:

Revenue: This represents the total income generated from sales, services, or other sources.

Cost of Goods Sold (COGS): These are the direct costs associated with producing or purchasing the goods or services that were sold.

Gross Profit: Calculated by subtracting COGS from revenue, it reflects the profitability of core business operations.

Operating Expenses: These encompass all other costs related to running the business, such as marketing, rent, utilities, and employee salaries.

Net Profit (or Loss): The final figure on the income statement, is calculated by subtracting operating expenses from gross profit and represents the ultimate measure of profitability.

Common mistakes made in the e-commerce Income (P&L) Statement

Creating an accurate e-commerce income statement is essential for making informed financial decisions. However, there are several common mistakes that businesses often make when preparing their income statements:

Failure to Account for All Expenses: Some e-commerce businesses may overlook certain operating expenses or underestimate their costs, leading to an inaccurate representation of their financial health.

Ignoring Depreciation: Depreciation of assets like equipment or software should be included in the income statement to reflect the true cost of using these assets over time.

Inconsistent Revenue Recognition: Businesses may not consistently recognize revenue, particularly when dealing with subscription-based models or long-term contracts, which can distort financial results.

Improper Inventory Valuation: E-commerce businesses need to accurately value their inventory, as using the wrong valuation method can lead to incorrect cost of goods sold (COGS) figures and, consequently, inaccurate gross profit calculations.

Not Adjusting for Seasonal Fluctuations: Many e-commerce businesses experience seasonality in their sales, but failing to adjust the income statement for these fluctuations can result in misleading financial data.

Miscalculating Gross Profit Margin: Incorrectly calculating the gross profit margin can misrepresent the efficiency of your core operations. It’s important to use the right formula to calculate this critical metric.

Neglecting Non-Recurring Items: Sometimes, one-time expenses or extraordinary gains are not properly distinguished in the income statement, which can skew the financial analysis.

Not Comparing to Previous Periods: Failing to compare current income statements to those of previous periods makes it difficult to track trends and assess the business’s financial progress.

Not Considering Tax Implications: Taxes are a significant expense for businesses. Not accounting for them accurately can lead to financial surprises and potentially impact cash flow.

Relying Solely on Accounting Software: While accounting software is valuable, it’s essential to have a deep understanding of financial principles and manually review and verify the numbers generated by the software.

Overlooking Non-Financial Metrics: While the income statement focuses on financial aspects, e-commerce businesses should also consider non-financial metrics like customer acquisition cost (CAC) and customer lifetime value (CLV) to gain a more holistic view of their performance.

To avoid these common mistakes, e-commerce businesses should invest in robust accounting practices, regularly review their income statements, seek professional assistance when necessary, and stay up-to-date with changes in accounting standards and tax regulations.

Why should you keep track of your Income (P&L) Statement?

Keeping track of your income statement is crucial for several compelling reasons:

Financial Health Assessment: Your income statement provides a snapshot of your business’s financial health. By regularly reviewing it, you can assess whether your business is profitable or facing financial challenges. It offers insights into how well your company is performing financially.

Profitability Monitoring: The income statement calculates your net profit, which is the amount left after deducting all expenses from your revenue. Monitoring net profit over time helps you gauge the success of your business and make necessary adjustments to enhance profitability.

Expense Management: It breaks down your expenses, allowing you to identify where your money is going. This insight is crucial for controlling costs and optimizing spending, ensuring that your business operates efficiently.

Decision-Making: An accurate Income (P&L) Statement is a valuable tool for making informed business decisions. Whether it’s setting prices, expanding operations, or adjusting your budget, having access to your financial data is essential for strategic planning.

Investor and Lender Confidence: If you seek external funding or investments, potential investors or lenders will scrutinize your income statement. A healthy income statement can instill confidence in stakeholders, making it easier to secure financing or attract investors.

Tax Compliance: Accurate Income (P&L) Statements are essential for tax compliance. They provide the necessary financial data for calculating and paying taxes, helping you avoid legal issues and penalties.

Performance Tracking: By comparing Income (P&L) Statements from different periods, you can track the performance and progress of your business. This historical data helps you identify trends, strengths, and weaknesses.

Operational Efficiency: Analyzing the income statement allows you to assess the efficiency of your operations. You can identify areas where you can cut costs, reallocate resources, or optimize processes to improve your bottom line.

Planning and Budgeting: Income (P&L) Statements are valuable for creating realistic budgets and financial forecasts. They serve as a foundation for setting financial goals and tracking progress toward achieving them.

Investor Relations: If your business is publicly traded, investors rely on income statements to evaluate your company’s financial performance. A well-maintained income statement can influence investor confidence and stock prices.

Legal and Regulatory Compliance: Depending on your jurisdiction and industry, legal and regulatory requirements may exist to maintain and report Income (P&L) Statements. Non-compliance can result in legal penalties.

How to analyze your e-commerce business’s income statement

Analyzing your e-commerce business’s income statement is crucial for gaining insights into its financial performance and making informed decisions. Here’s a step-by-step guide on how to effectively analyze your income statement:

Review the Time Period: Start by identifying the time period covered by the Income (P&L) Statement. Ensure you’re comparing it to the appropriate historical data or industry benchmarks.

Check for Accuracy: Verify that all the numbers on the Income (P&L) Statement are accurate and properly categorized. Look for any discrepancies or errors in calculations.

Understand Revenue Sources: Examine the revenue section to understand where your income is coming from. Identify the primary sources of revenue, such as product sales, subscriptions, or services.

Analyze Cost of Goods Sold (COGS): Evaluate the COGS section to determine the direct costs associated with producing or purchasing the goods or services sold. Ensure that inventory valuation methods are consistent and accurate.

Calculate Gross Profit: Subtract COGS from revenue to calculate the gross profit. Assess whether your gross profit margin is in line with industry standards or your own historical performance.

Review Operating Expenses: Analyze the operating expenses section. Identify which expenses are essential for running your e-commerce business and look for any unusual or unexpected costs.

Calculate Net Profit: Subtract the total operating expenses from the gross profit to calculate the net profit (or loss). This figure represents the overall profitability of your e-commerce business.

Assess Net Profit Margin: Calculate the net profit margin by dividing net profit by total revenue and multiplying by 100 to get a percentage. A higher net profit margin indicates better profitability.

Compare to Previous Periods: Compare the current income statement to previous periods, such as the previous month, quarter, or year. Look for trends and changes in revenue, expenses, and profitability.

Analyze Expense Ratios: Calculate expense ratios by dividing individual operating expenses by total revenue. This helps identify which expenses have the most significant impact on your profitability.

Identify Seasonal Trends: If your business experiences seasonal fluctuations, assess how these affect your income statement. Consider how you can adjust your operations and budget accordingly.

Benchmark Against Industry Averages: Compare your Income (P&L) Statement to industry benchmarks to see how your business stacks up against competitors. Identify areas where you may need to improve.

Assess Cost Control: Look for opportunities to control costs and improve efficiency. Consider whether certain operating expenses can be reduced without compromising quality or customer satisfaction.

Evaluate Pricing Strategies: If your gross profit margin is lower than desired, analyze your pricing strategies. Determine if price adjustments are necessary to improve profitability.

Set Financial Goals: Use the insights gained from your analysis to set financial goals for your e-commerce business. Create actionable plans to achieve these goals.

Consult with Experts: If you’re unsure about any aspect of your income statement or need assistance with financial analysis, consider consulting with accountants or financial advisors who specialize in e-commerce businesses.

Regularly Monitor and Update: Financial analysis is an ongoing process. Regularly monitor your income statement and update your analysis as new data becomes available. Adjust your strategies based on the insights you gain.

Breaking down your income statement

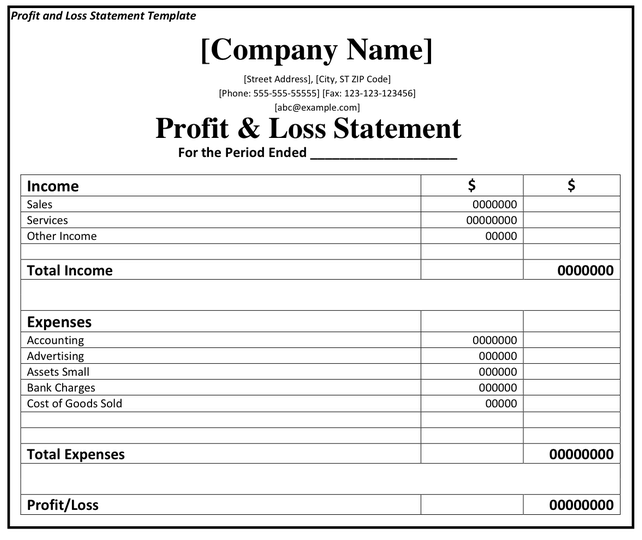

Breaking down your income statement involves a detailed examination of each component and line item to gain a comprehensive understanding of your business’s financial performance. Here’s a breakdown of the typical sections and key elements found in an income statement:

Revenue (Sales):

This is the starting point of your income statement.

It includes all the income generated from sales, services, or other revenue streams.

Segment revenue sources (e.g., product sales, subscriptions, service fees) for deeper insights.

Cost of Goods Sold (COGS):

These are the direct costs associated with producing or purchasing the goods or services that you sell.

It includes expenses like raw materials, manufacturing costs, and shipping fees.

Gross Profit:

Calculated by subtracting COGS from revenue.

Represents the profitability of your core business operations.

Operating Expenses:

This section encompasses all other costs related to running your business.

Common operating expenses include marketing, rent, utilities, employee salaries, and office supplies.

Operating expenses are typically categorized into selling, general, and administrative expenses (SG&A).

Operating Income (or Loss):

Calculated by subtracting total operating expenses from gross profit.

It reflects the profitability of your business before considering other income or expenses.

Other Income and Expenses:

This section includes non-operating items like interest income, interest expenses, and gains or losses from investments.

Non-recurring or extraordinary items may also be reported here.

Net Profit (or Loss):

Calculated by subtracting total other income and expenses from operating income.

Represents the ultimate measure of your business’s profitability.

A positive net profit indicates a profit, while a negative value suggests a loss.

Earnings Before Interest and Taxes (EBIT):

Also known as operating profit, EBIT represents the profit generated by your core operations before considering interest and taxes.

Calculated by subtracting interest and taxes from operating income.

Interest Expenses and Income:

Interest expenses reflect the cost of borrowing, such as loans or credit lines.

Interest income includes earnings from investments or savings accounts.

Income Before Taxes (EBT):

Calculated by subtracting interest expenses and income from EBIT.

Represents the profit or loss before accounting for taxes.

Income Taxes:

This section shows the taxes owed by your business based on its taxable income.

Tax rates and tax regulations can significantly impact this figure.

Net Income (or Loss) After Taxes:

The final line item on your Income (P&L) Statement is calculated by subtracting income taxes from EBT.

It’s the actual profit or loss your business reports for tax purposes.

Analyzing each of these components in detail helps you gain insights into your revenue sources, the cost structure of your business, your profitability, and your financial performance. By breaking down your income statement, you can make informed decisions, track trends over time, and identify areas for improvement in your business operations.

Gross profit and gross profit margin

Gross profit and gross profit margin are important financial metrics that provide insights into a company’s profitability and the efficiency of its core operations. Here’s what each term means:

Gross Profit:

Gross profit is the amount of money a company earns from its core business activities after deducting the direct costs associated with producing or purchasing the goods or services it sells.

To calculate gross profit, use the following formula: Gross Profit = Revenue – Cost of Goods Sold (COGS)

For example, if a company generates $100,000 in revenue from selling products and incurs $60,000 in direct production costs, the gross profit is $40,000.

Gross Profit Margin:

Gross profit margin is expressed as a percentage and represents the portion of revenue that remains after covering the cost of goods sold.

To calculate gross profit margin, use the following formula: Gross Profit Margin = (Gross Profit / Revenue) x 100%

Using the example above, if the company’s revenue is $100,000 and the gross profit is $40,000, the gross profit margin would be (40,000 / 100,000) x 100% = 40%.

Gross profit margin is a critical metric because it measures the efficiency of a company’s core operations in generating profit. A higher gross profit margin indicates that a company is more efficient in producing or sourcing its products or services.

A gross profit margin of 40% means that for every dollar in revenue, the company retains 40 cents after covering the direct production costs.

Gross profit and gross profit margin are particularly important for businesses with goods-based revenue models, such as e-commerce companies, manufacturers, and retailers. These metrics help assess the profitability of the products or services a company offers and provide insights into pricing strategies, cost control, and overall financial health.

A rising gross profit margin over time suggests improved efficiency and pricing power, while a declining margin may indicate increased production costs or pricing pressures. It’s essential for businesses to monitor and analyze these metrics to make informed decisions and optimize profitability.

Comparison with percentages

Comparing financial metrics using percentages can provide valuable insights into a company’s performance and help with benchmarking against industry standards or historical data. Let’s explore how percentages can be used to compare financial metrics, focusing on gross profit and gross profit margin:

1. Gross Profit Comparison with Percentages:

Suppose you want to compare the gross profit of two companies, Company A and Company B, over a certain period. Here’s how you can do it with percentages:

Company A: Gross Profit = $200,000

Company B: Gross Profit = $250,000

Now, calculate the percentage difference:

Percentage Difference = [(Company B Gross Profit – Company A Gross Profit) / Company A Gross Profit] x 100%

Percentage Difference = [($250,000 – $200,000) / $200,000] x 100% Percentage Difference = ($50,000 / $200,000) x 100% Percentage Difference = 25%

In this comparison, Company B’s gross profit is 25% higher than Company A’s. This percentage comparison highlights the difference in the absolute values of gross profit between the two companies.

2. Gross Profit Margin Comparison with Percentages:

Let’s compare the gross profit margin of Company X and Company Y:

Company X: Gross Profit = $80,000, Revenue = $200,000

Company Y: Gross Profit = $70,000, Revenue = $150,000

Calculate the gross profit margins for both companies and the percentage difference:

Company X Gross Profit Margin = ($80,000 / $200,000) x 100% = 40%

Company Y Gross Profit Margin = ($70,000 / $150,000) x 100% = 46.67%

Percentage Difference = [(Company Y Gross Profit Margin – Company X Gross Profit Margin) / Company X Gross Profit Margin] x 100%

Percentage Difference = [(46.67% – 40%) / 40%] x 100% Percentage Difference = (6.67% / 40%) x 100% Percentage Difference = 16.67%

In this comparison, Company Y has a gross profit margin that is approximately 16.67% higher than Company X’s. This percentage comparison indicates that Company Y is retaining a larger portion of its revenue as gross profit.

Comparing financial metrics with percentages allows for a more meaningful and standardized evaluation, especially when dealing with companies of different sizes or when assessing changes in performance over time. It provides a relative perspective that can aid in decision-making and strategic planning.

Why is the Income Statement Important for E-commerce?

Tracking Revenue and Expenses

For e-commerce businesses, tracking revenue and expenses is essential. Your income statement provides a clear breakdown of all income sources, including sales, subscriptions, and other revenue streams. On the flip side, it outlines various expenses such as marketing, shipping, and operating costs. This insight helps you identify areas where you can optimize your spending and increase profitability.

Assessing Profitability

Profitability is the lifeblood of any business. The Income (P&L) Statement calculates your net profit, which is the amount left after deducting all expenses from your revenue. Monitoring your net profit over time allows you to gauge the health of your e-commerce venture and make necessary adjustments to enhance profitability.

Components of an Income (P&L) Statement

The components of an income statement are vital for comprehending your business’s financial performance.

Revenue

Revenue, also known as sales or turnover, represents the total income generated from your e-commerce operations. It’s the starting point of your income statement.

Cost of Goods Sold (COGS)

COGS includes the direct costs associated with producing or purchasing the goods or services that you sell. In e-commerce, this encompasses expenses like inventory costs and shipping fees.

Gross Profit

Gross profit is calculated by subtracting the COGS from your total revenue. It reflects the profitability of your core business operations.

Operating Expenses

Operating expenses encompass all other costs related to running your e-commerce business, such as marketing, rent, utilities, and employee salaries.

Net Profit

Net profit is the ultimate measure of your business’s profitability. It is calculated by subtracting operating expenses from gross profit.

Calculating Gross Profit Margin

Gross profit margin is a crucial metric for e-commerce businesses. It measures the profitability of your core operations as a percentage of your revenue. A higher gross profit margin indicates better efficiency in producing or sourcing your products.

Analyzing Operating Expenses

Effectively managing your operating expenses is key to improving your e-commerce business’s bottom line. Regularly reviewing your Income (P&L) Statement can help you identify areas where you can cut costs or allocate resources more efficiently.

Net Profit

Net profit is what’s left in your coffers after all expenses have been accounted for. It’s the true measure of your business’s success, and keeping a close eye on it is essential for long-term sustainability.

Common E-commerce Income Statement Challenges

E-commerce businesses often face unique challenges when preparing an Income (P&L) Statement.

Seasonal Fluctuations

Many e-commerce businesses experience seasonal fluctuations in sales. Your Income (P&L) Statement should reflect these fluctuations accurately to help you plan for lean periods.

Inventory Valuation

Properly valuing your inventory is crucial. Using the wrong valuation method can distort your Income (P&L) Statement, leading to inaccurate financial decisions.

Using the Income (P&L) Statement for Business Decision-Making

Your Income (P&L) Statement is not just a financial report; it’s a powerful tool for making informed business decisions.

Pricing Strategies

By analyzing your Income (P&L) Statement, you can adjust your pricing strategies to maximize profit without compromising competitiveness.

Cost Control

Identifying areas of overspending in your operating expenses can lead to cost-saving measures that directly impact your bottom line.

Tools for Creating and Analyzing Income (P&L) Statement

There are various accounting software tools available that can simplify the process of creating and analyzing income statements for your e-commerce business.

Best Practices for E-commerce Income (P&L) Statement

To make the most of your Income (P&L) Statement, consider implementing these best practices:

Keep accurate records of all transactions.

Regularly reconcile your financial data.

Seek professional accounting assistance if needed.

How often should I review my income statement for my e-commerce business?

It’s advisable to review your Income (P&L) Statement monthly to stay on top of your financial performance.

What is a good gross profit margin for an e-commerce business?

A healthy gross profit margin for e-commerce typically falls between 40% to 60%, but this can vary by industry.

How can I deal with seasonal fluctuations in my income statement?

To manage seasonal fluctuations, create a budget that accounts for lean periods and consider adjusting marketing strategies accordingly.

Can I prepare an income statement manually, or do I need accounting software?

While you can prepare an Income (P&L) Statement manually, accounting software can streamline the process and reduce the chances of errors.

Where can I find professional help for understanding and analyzing my income statement?

You can seek assistance from certified accountants or financial advisors who specialize in e-commerce businesses. They can provide expert guidance tailored to your specific needs.