Blog Grid

- Home

- Blog Grid

The Importance of Comparing the Insurance Rates

It is a long established fact that a reader will be distra

by the readable content of a page when looking at its

layout. The point of using Lorem Ipsum is that it has

a more-or-less normal distribution of letters, as opposed

to using \’Content here, content here\’, making it look like

readable English. Many desktop publishing packages and

web page editors now use Lorem Ipsum as their default

model text, and a search for \’lorem ipsum\’ will uncover

many web sites still in their infancy. Various versions

have evolved over the years, sometimes by accident,

sometimes on purpose (injected humour and the like).

There are many variations of passages of Lorem Ipsum

available, but the majority have suffered alteration in

some form, by injected humour, or randomised words

don\’t look even slightly believable. If you are going to

passage of Lorem Ipsum, you need to be sure there isn\’t

anything embarrassing hidden in the middle of text.

5 Unbelievable Facts about Gas Stations

It is a long established fact that a reader will be distra

by the readable content of a page when looking at its

layout. The point of using Lorem Ipsum is that it has

a more-or-less normal distribution of letters, as opposed

to using \’Content here, content here\’, making it look like

readable English. Many desktop publishing packages and

web page editors now use Lorem Ipsum as their default

model text, and a search for \’lorem ipsum\’ will uncover

many web sites still in their infancy. Various versions

have evolved over the years, sometimes by accident,

sometimes on purpose (injected humour and the like).

There are many variations of passages of Lorem Ipsum

available, but the majority have suffered alteration in

some form, by injected humour, or randomised words

don\’t look even slightly believable. If you are going to

passage of Lorem Ipsum, you need to be sure there isn\’t

anything embarrassing hidden in the middle of text.

How to Save on Homeowners Insurance

How to Save on Homeowners Insurance

It is a long established fact that a reader will be distra

by the readable content of a page when looking at its

layout. The point of using Lorem Ipsum is that it has

a more-or-less normal distribution of letters, as opposed

to using \’Content here, content here\’, making it look like

readable English. Many desktop publishing packages and

web page editors now use Lorem Ipsum as their default

model text, and a search for \’lorem ipsum\’ will uncover

many web sites still in their infancy. Various versions

have evolved over the years, sometimes by accident,

sometimes on purpose (injected humour and the like).

There are many variations of passages of Lorem Ipsum

available, but the majority have suffered alteration in

some form, by injected humour, or randomised words

don\’t look even slightly believable. If you are going to

passage of Lorem Ipsum, you need to be sure there isn\’t

anything embarrassing hidden in the middle of text.

How do you qualify for a loan in South Africa?

Qualifying for a loan in South Africa can seem daunting without proper guidance. Securing a loan can be a significant step towards achieving your financial goals, whether it’s purchasing a home, starting a business, or covering unexpected expenses. I’ll walk you through the essential steps and requirements to help you navigate the loan qualification process smoothly.

Qualification for a loan in South Africa

Qualifying for a loan in South Africa involves several factors that lenders consider before approving your application. These criteria are crucial for a successful loan application, from creditworthiness to income verification.

Credit Score and History

Your credit score plays a pivotal role in determining your eligibility for a loan. Lenders assess your credit history to evaluate your past repayment behavior and assess the risk associated with lending to you.

Income and Employment Verification

Lenders need assurance that you have a stable source of income to repay the loan. Providing proof of employment and income through payslips, bank statements, or tax returns is typically required during the application process.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is another crucial factor that lenders consider. This ratio compares your monthly debt payments to your gross monthly income. A lower DTI ratio indicates that you have more disposable income available to repay the loan, increasing your chances of approval.

Loan Amount and Term

Determining the loan amount and repayment term that aligns with your financial situation is essential. Consider factors such as your income, expenses, and long-term financial goals when deciding on the loan amount and duration.

Collateral and Guarantors

Some loans in South Africa may require collateral or a guarantor to secure the lender’s investment. Collateral could be in the form of property, vehicles, or other valuable assets that you own. A guarantor, on the other hand, is someone who agrees to take responsibility for the loan if you default on payments.

Interest Rates and Fees

The interest rates and fees associated with the loan are crucial for assessing its affordability. Compare offers from different lenders to find the most competitive rates and favorable terms.

Loan Application Process

Once you’ve gathered all the necessary documentation and information, it’s time to initiate the loan application process. Be prepared to fill out forms, undergo credit checks, and provide additional documentation as requested by the lender.

Tips for Improving Your Loan Eligibility

- Maintain a good credit score by paying bills on time and avoiding excessive debt.

- Reduce existing debt to improve your DTI ratio.

- Save for a down payment to reduce the loan amount and lower the lender’s risk.

- Consider enlisting a co-borrower or guarantor with a strong credit history to bolster your application.

FAQs

Can I qualify for a loan in South Africa with bad credit?

Yes, some lenders offer loans specifically designed for individuals with less-than-perfect credit. However, these loans may come with higher interest rates or stricter terms.

What documents do I need to apply for a loan in South Africa?

Required documents may vary depending on the lender and the type of loan in South Africa. Generally, you’ll need proof of identity, proof of income, bank statements, and details of any existing debts.

How long does it take to get approved for a loan in South Africa?

The approval timeline can vary depending on the lender, the complexity of your application, and other factors. Some lenders offer instant approval, while others may take several days to process your application.

Can I apply for multiple loans simultaneously?

While it’s possible to apply for multiple loans, doing so can negatively impact your credit score and raise red flags for lenders. It’s advisable to carefully consider your options and avoid overextending yourself financially.

What happens if I miss a loan payment?

Missing a loan payment can have serious consequences, including late fees, penalty interest rates, and damage to your credit score. Contact your lender immediately if you’re experiencing financial difficulties to explore alternative repayment options.

Is it possible to pay off a loan early?

Yes, many lenders allow early repayment of loans without penalty. Paying off your loan ahead of schedule can save you money on interest and improve your overall financial health.

Conclusion

Qualifying for a loan in South Africa requires careful planning, financial discipline, and a thorough of application process. By focusing on improving your creditworthiness, managing your finances responsibly, and exploring your options, you can increase your chances of securing the loan you need to achieve your goals.

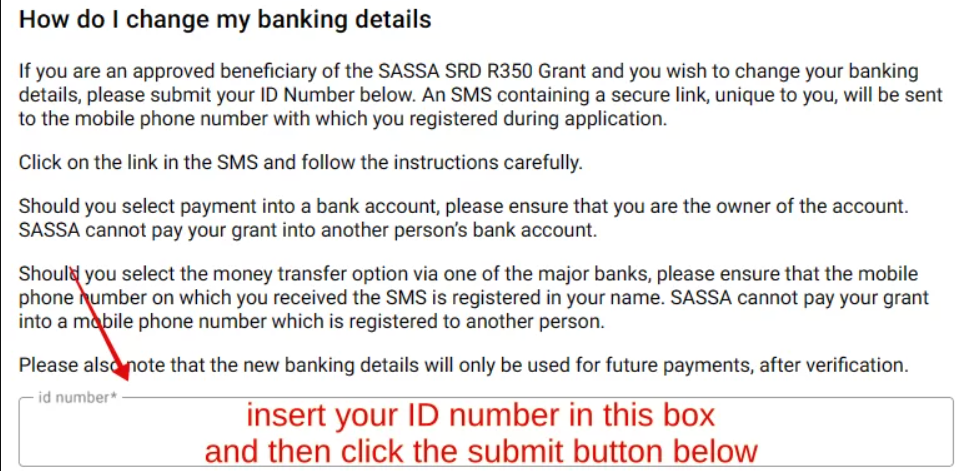

How to Change Your Banking Details for Your SASSA R350 Grant

Through several grants, including the SASSA R350 Grant relief, the South African Social Security Agency (SASSA) offers qualifying residents vital financial support. If you’re a recipient of the SASSA R350 grant and need to update your banking details, you can do so through a straightforward process.

Here’s a guide on how to change your banking details for your SASSA R350 grant:

1. Contact SASSA: The first step is to get in touch with SASSA to initiate the process of changing your banking details. You can reach out to them through their toll-free helpline at 0800 60 10 11. Prepare to provide your ID number and other relevant information for verification purposes.

2. Request the Change: Inform the SASSA representative that you need to update your banking details for your R350 grant. They will guide you through the process and inform you of any required documentation or information.

3. Provide Necessary Information: Depending on SASSA’s requirements, you may need to submit certain documents to facilitate the change. These documents may include a certified copy of your ID, proof of residence, and proof of your new banking details (such as a bank statement or a stamped letter from your bank).

4. Complete Forms: SASSA may require you to fill out specific forms related to changing banking details. Ensure that you complete these forms accurately and follow any instructions provided by SASSA.

5. Submit Documentation: Once you have all the necessary documentation and forms filled out, submit them to SASSA through the designated channels. This could involve emailing the documents, faxing them, sending them via post, or visiting a SASSA office in person, depending on their procedures.

6. Follow-Up: After submitting your request, it’s essential to follow up with SASSA to confirm that your banking details have been successfully updated. You can do this by contacting them again through their helpline or visiting a SASSA office if necessary.

7. Confirmation: Once SASSA has processed your request and updated your banking details, they should provide confirmation. This confirmation may be sent to you via email, SMS, or letter. Be sure to retain this confirmation for your records.

By following these steps and ensuring that you provide accurate and complete information to SASSA, you can successfully change your banking details for your SASSA R350 grant. Timely updating of your banking details ensures that you continue to receive your grant payments without any interruptions.

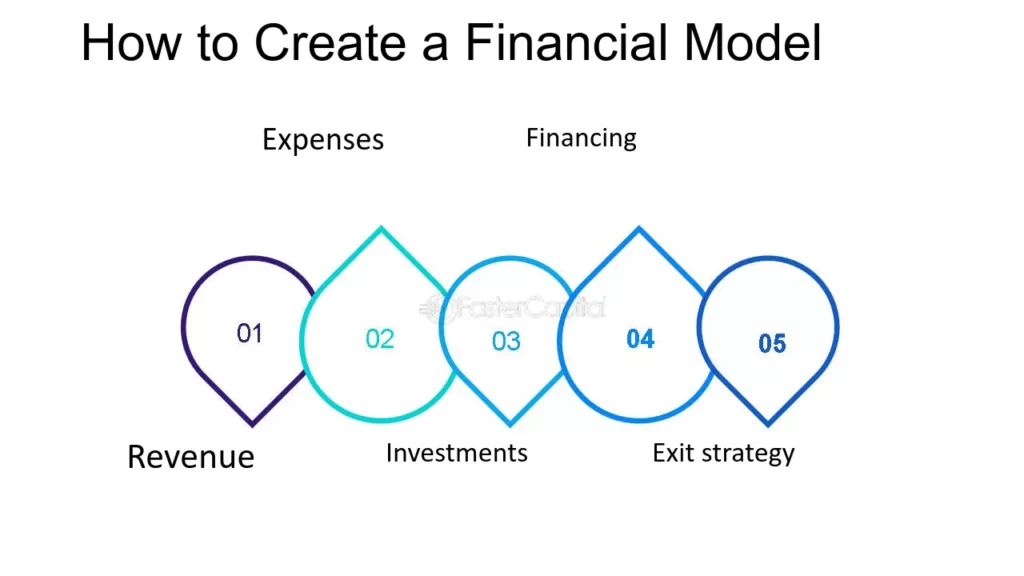

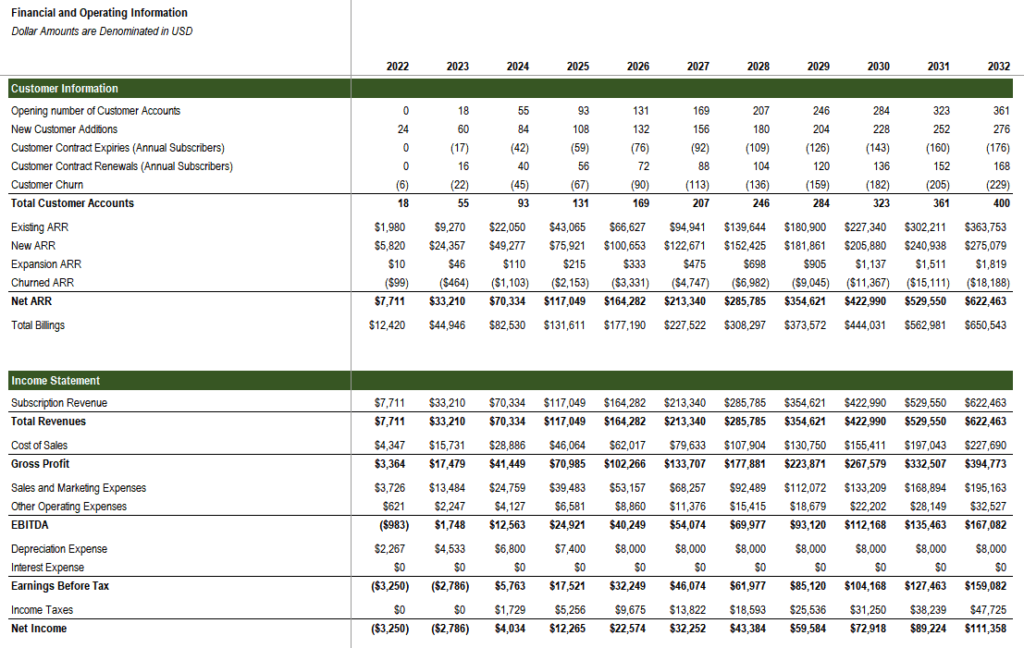

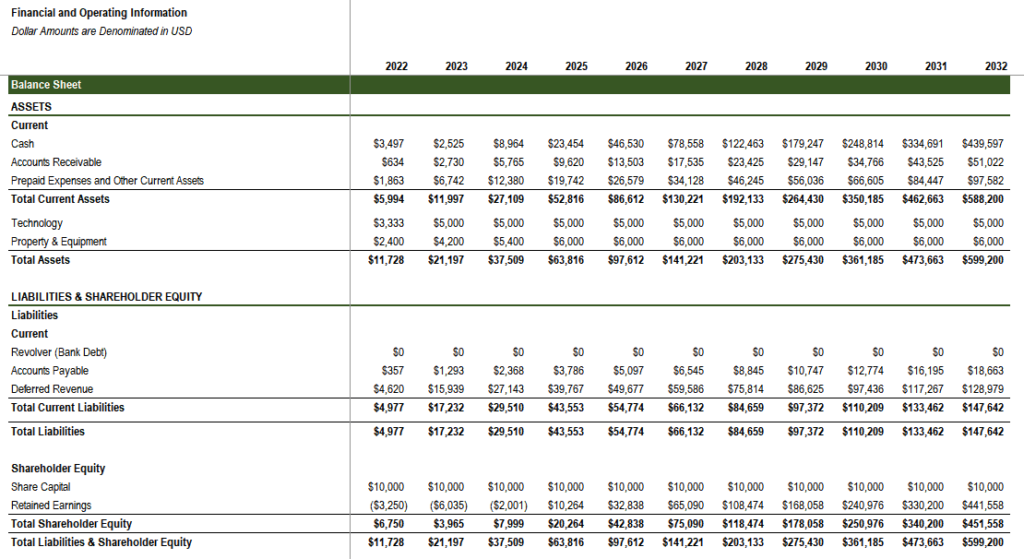

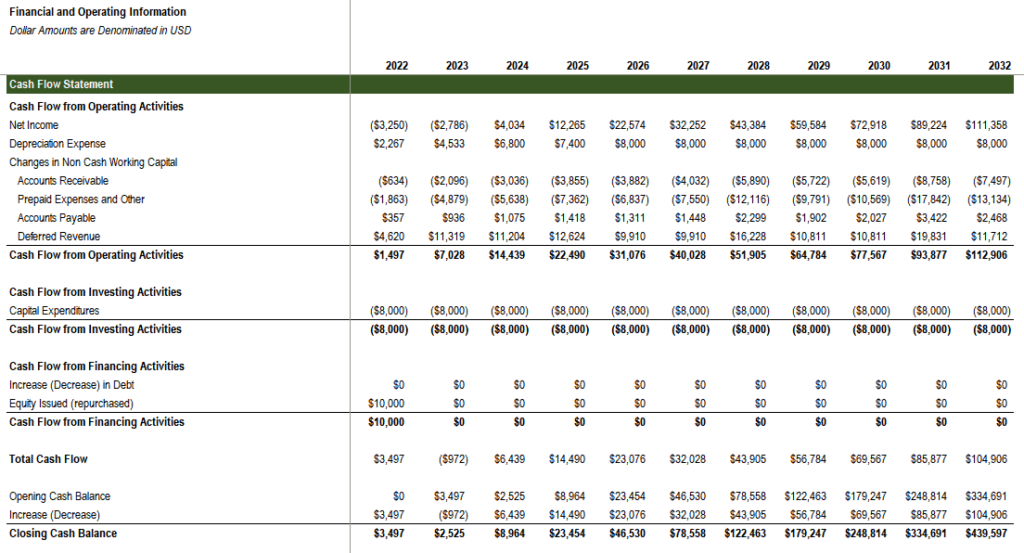

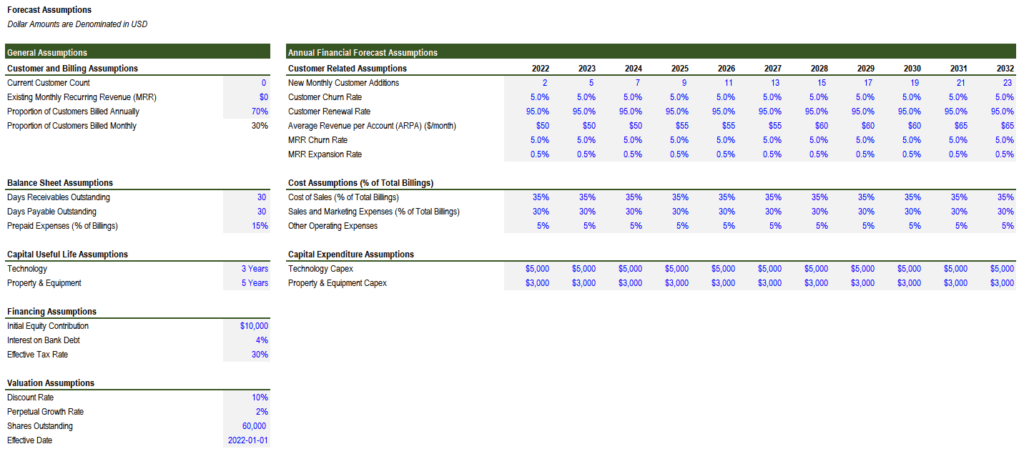

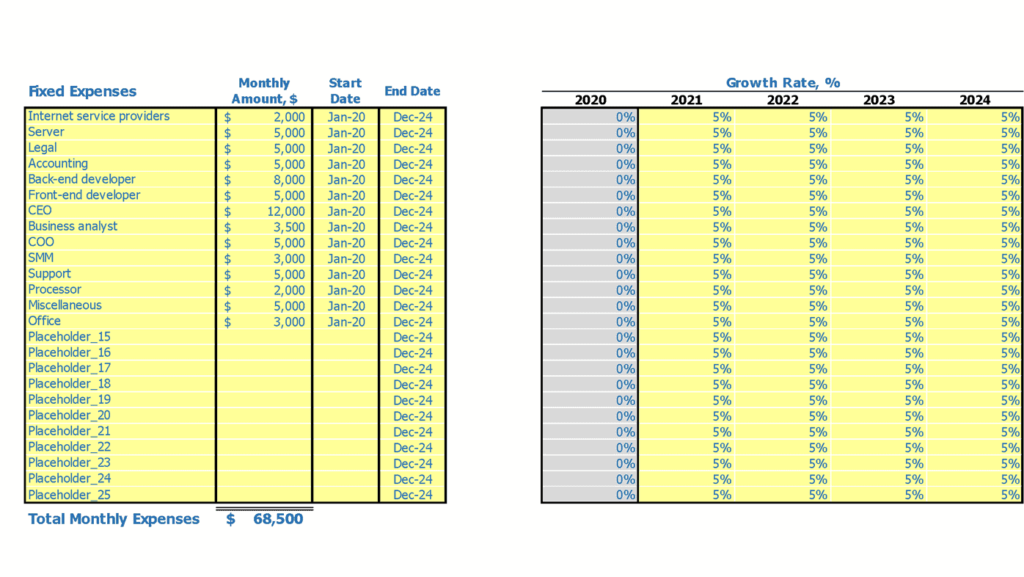

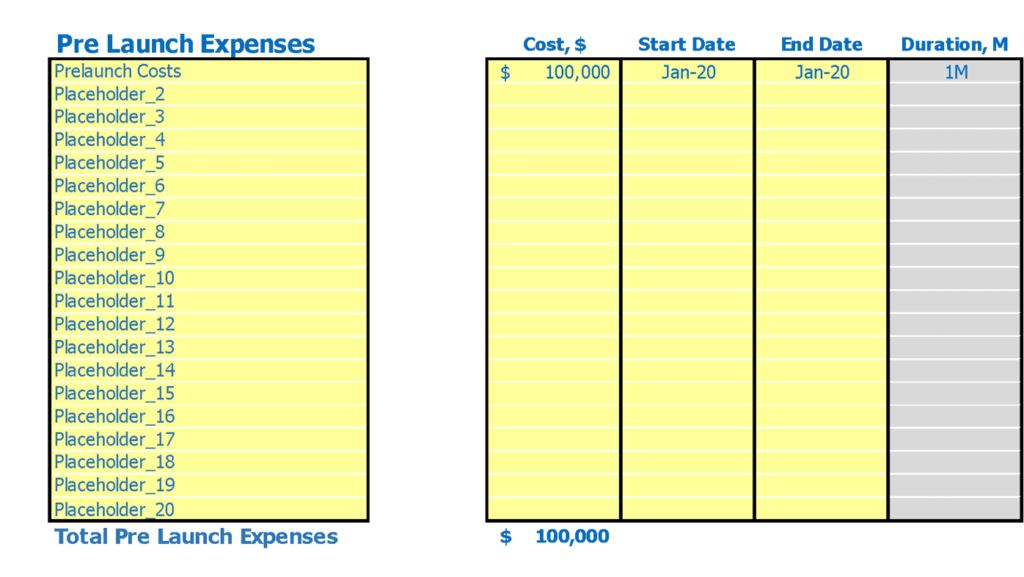

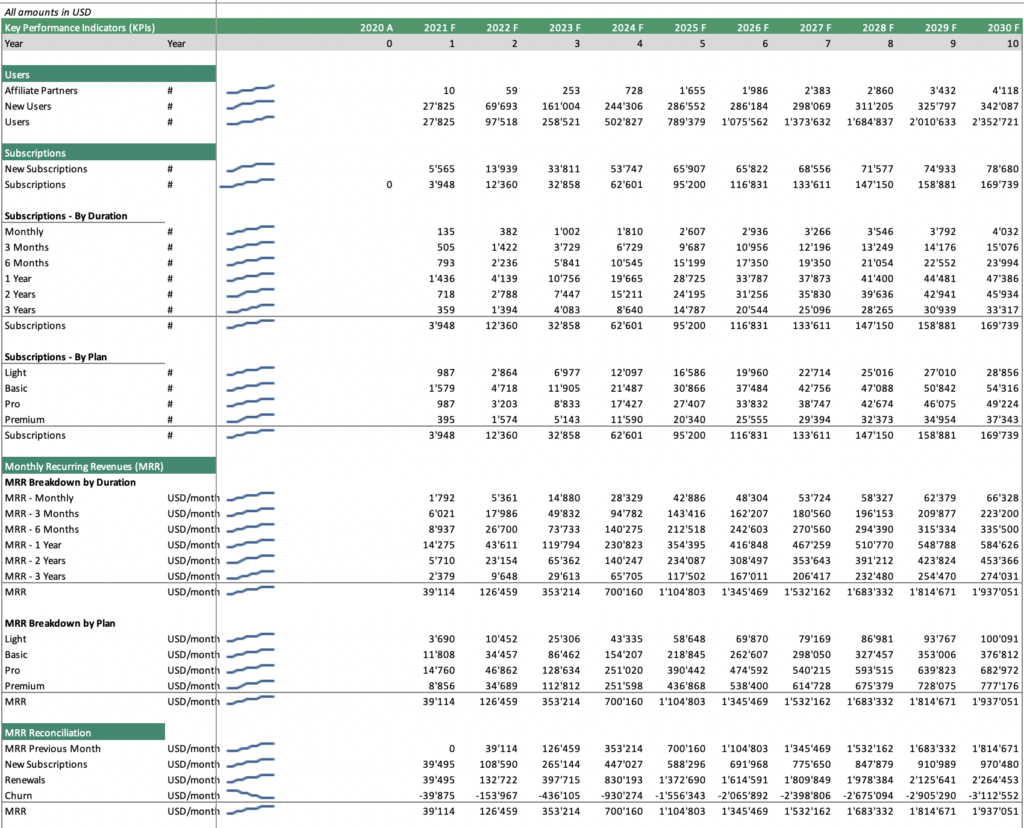

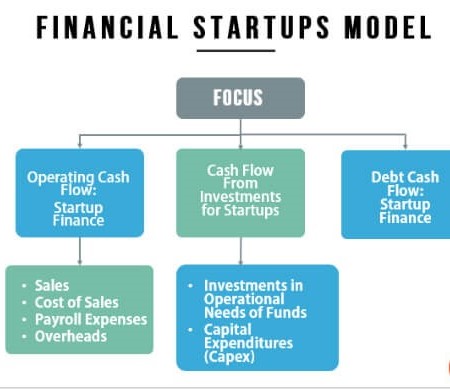

Financial Modeling for Pre-Seed Startups

Financial Modeling for Pre-Seed Startups is a critical aspect of planning and strategizing.

In essence, it involves creating a dynamic representation of a company’s financial situation, projecting future performance, and analyzing potential outcomes.

For pre-seed startups navigating the challenging landscape of entrepreneurship, effective financial modeling is more than a tool; it’s a compass guiding them through the uncharted waters of business.

The pre-seed stage: exhilarating, chaotic, and, quite frankly, a little nerve-wracking. You’ve got a groundbreaking idea, a passionate team, and a caffeine drip that rivals Niagara Falls.

But amidst the hustle, investors beckon, asking the dreaded question: “Show me the money.” That’s where financial modeling comes in, but at this stage, forget complexity.

We’re talking lean, mean, storytelling machines, not crystal balls.

Think lean, not Lamborghini: Ditch the multi-sheet monsters. This early game requires agility, not spreadsheets the size of Texas.

A single page, focused on core metrics like customer acquisition cost, lifetime value, and burn rate, is your playground.

Remember, investors want to see your understanding of the business, not your Excel wizardry.

Assumptions? Keep it real: Forget five-year forecasts built on air. Use reasonable estimates based on market research and your gut instinct.

Think customer conversion rates, pricing models, and even napkin math. Transparency is key, so document your assumptions.

Scenario planning: the crystal ball slayer: The future’s a fickle beast. Build different scenarios with varying assumptions.

What if customer acquisition takes longer?

What if revenue explodes?

This shows investors you’re prepared for the rollercoaster ride (and hey, it forces you to think through potential roadblocks).

Iteration is queen (or king): Your business model is a living, breathing beast. As you learn, your model evolves. Don’t be afraid to tweak, update, and adapt.

This isn’t about predicting the future; it’s about understanding your present and navigating the twists and turns ahead.

Storytelling: where numbers sing: Let’s face it, spreadsheets can be snooze-inducing. Use your model to weave a compelling narrative about your business.

Highlight key insights, showcase your growth potential, and most importantly, convince investors you’re the Elon Musk of your niche (minus the Twitter meltdowns, hopefully).

Tools for the lean and mean: Ditch the bespoke consultants and fancy software. Tools like Pry and Google Sheets offer simple, accessible platforms to build your model.

Remember, it’s not about the bells and whistles; it’s about telling your story through numbers.

The bottom line: Pre-seed financial modeling isn’t about precision; it’s about painting a picture with a brush dipped in informed assumptions and sprinkled with strategic foresight.

It’s a tool to guide your decisions, attract investors, and most importantly, prove you’ve got the brains (and the hustle) to turn your dream into reality.

So, roll up your sleeves, grab your trusty spreadsheet, and start demystifying those dollars. The investors await your masterpiece.

Now, conquer the pre-seed stage, armed with your lean, mean, storytelling financial model! Remember, it’s not about predicting the future; it’s about shaping it.

And who knows your next model might just be the one that lands you on Forbes, not just in your dreams, but on the cover.

Importance of Financial Modeling for Pre-seed Startups

Attracting Investors

Investors look for startups with a clear and well-thought-out financial plan. A robust financial model instills confidence and demonstrates that the Financial Modeling for Pre-Seed Startups has thoroughly considered potential challenges and opportunities.

Strategic Decision-Making

Financial models serve as decision-making tools. They enable startups to assess the financial implications of different strategies, helping them make informed choices that align with their long-term goals.

Risk Mitigation

By identifying potential financial risks through modeling, startups can implement mitigation strategies. Whether it’s adjusting spending habits or securing additional funding, proactive risk management is essential for survival.

Common Mistakes to Avoid

Overly Optimistic Projections

While optimism is crucial in entrepreneurship, overly optimistic financial projections can lead to unrealistic expectations. Pre-seed Startups should strike a balance between ambition and practicality.

Ignoring Market Trends

Financial Modeling for Pre-Seed Startups should consider market trends and external factors. Ignoring these elements can result in a misalignment between projections and reality.

Neglecting Contingency Planning

Financial Modeling for Pre-Seed Startups should always plan for the unexpected. Neglecting contingency planning can leave a business vulnerable to unforeseen challenges.

FAQs

What is the role of Financial Modeling for Pre-Seed Startups’ success?

Financial Modeling for Pre-Seed Startups is pivotal in startup success by providing a roadmap for financial decisions, attracting investors, and mitigating risks.

How frequently should a Financial Modeling for Pre-Seed Startups update its financial model?

Financial Modeling for Pre-Seed Startups should update their financial models regularly, especially in response to changes in the business environment or strategic shifts.

Are there specific industries where financial modeling is more crucial?

While financial modeling is important across industries, it’s particularly crucial in sectors with high uncertainty, rapid changes, and intense competition.

Can a Financial Modeling for Pre-Seed Startups succeed without a detailed financial model?

While success is possible, a detailed financial model enhances a startup’s chances by providing a structured approach to decision-making and risk management.

What are the potential risks of inadequate financial modeling?

Inadequate financial modeling can lead to unrealistic expectations, poor decision-making, and increased vulnerability to unforeseen challenges. It’s a crucial aspect of long-term planning for startups.

Conclusion

In the ever-evolving landscape of pre-seed startups, financial modeling emerges as a linchpin for success.

By navigating the intricacies of revenue projections, expense forecasting, and cash flow analysis, startups can chart a course toward sustainable growth.

It’s not just about numbers; it’s about making informed decisions that lay the foundation for a resilient and thriving business.

How do you create a financial model for investors?

In this article, we’ll explore the intricacies of creating a financial model for investors that speaks to investors effectively. For entrepreneurs seeking investment, a polished financial model is the Rosetta Stone which translates potential into concrete value.

It’s not just about spreadsheets and formulas; it’s a compelling story about your business’s future, told in the language investors understand.

So, how do you craft a financial model that captivates them?

Steps to Create a financial model for investors

1. Define Your Purpose and Audience

Is your model for securing seed funding, attracting venture capitalists, or pitching a merger? Understanding the purpose dictates the level of detail and complexity.

Tailor it to your audience’s expectations and risk tolerance. Investors seeking high-growth startups can handle bolder assumptions, while banks might require conservative projections.

2. Gather and Organize Data create a financial model for investors

Think of data as your building blocks. Historical financial statements, industry benchmarks, and competitor analysis provide a solid foundation.

Ensure data accuracy and consistency, and present it in a way that’s easy to understand and navigate. Transparency builds trust and allows investors to delve deeper.

3. Choose the Right Tool to create a financial model for investors

Excel might be your comfortable go-to, but consider dedicated financial modeling software. Tools like FinPlan, Valuate, or Anaplan offer user-friendly interfaces, built-in templates, and robust functionalities for scenario testing and sensitivity analysis.

Choose a tool that suits your technical expertise and the model’s complexity.

4. Build the Core Statements create a financial model for investors

The Income Statement, Balance Sheet, and Cash Flow Statement are the backbone of your model. Start with historical data and build projections for revenue, expenses, and profitability.

Use a bottom-up approach for detailed forecasting, or a top-down approach for broader strategic direction.

5. Layer on Assumptions and Sensitivities

Your model isn’t a crystal ball but informed assumptions fuel its engine. Document key assumptions like sales growth rates, marketing spending, or price changes.

Don’t shy away from sensitivity analysis, showing how the model reacts to different scenarios. This showcases your foresight and understanding of potential risks and rewards.

6. Make it Transparent and Easy to Use

Remember, clarity is your friend. Use clear labels, consistent formatting, and intuitive navigation.

Color coding, charts, and graphs can bring data to life and make complex relationships readily apparent. Investors shouldn’t need a decoder ring to understand your story.

7. Don’t Forget the Story

Numbers tell a story, but sometimes they need a narrator. Explain your assumptions, highlight key growth drivers, and emphasize the opportunities your business presents.

Connect the dots between financial projections and your broader vision, demonstrating how your company will create value for investors.

8. Review and Refine

Your model is a living document, not a static snapshot. Regularly review its accuracy, update assumptions based on new information, and be prepared to adapt to changing market conditions.

This demonstrates agility and responsiveness, attractive qualities for any investor.

Building a winning financial model for investors is about more than just formulas and calculations. It’s about crafting a compelling narrative, fueled by data, that paints a clear picture of your business’s potential.

By following these steps and focusing on clarity, transparency, and a compelling story, you can turn your financial model into a powerful tool that unlocks the door to investment and propels your business forward.

Common Mistakes to Avoid

A. Overcomplicating the model

While detail is important, avoid overcomplicating the model with unnecessary information. Keep it focused on the key metrics that matter.

B. Ignoring industry benchmarks

Benchmarking against industry standards provides context for your financial model. Ignoring these benchmarks can lead to misguided projections.

C. Neglecting risk factors

Identify and address potential risks. Ignoring these factors can result in an incomplete and unrealistic representation of the business.

FAQs

How often should I update my financial model?

It’s advisable to update your financial model regularly, especially when there are significant changes in your business, market conditions, or industry trends.

Can I use free financial modeling tools?

While free tools like Excel are widely used, specialized financial modeling software can offer advanced features and automation for more complex models.

What role does scenario analysis play in a financial model?

Scenario analysis helps assess how changes in variables impact the financial model, providing insights into potential outcomes under different conditions.

How important is industry benchmarking in financial modeling?

Industry benchmarking is crucial as it provides context for your financial model, allowing investors to compare your performance against industry standards.

Is it necessary to tailor financial models for different industries?

Yes, customizing financial models for specific industries ensures that the metrics and assumptions align with the unique characteristics of each sector.

Conclusion

A. Recap of key points

Creating a financial model for investors is a multifaceted process that involves meticulous planning, realistic projections, and transparent communication.

The key components, steps, and best practices outlined in this article serve as a comprehensive guide for entrepreneurs seeking to create investor-friendly financial models.

B. Emphasis on the role of financial model for investors

financial model for investors are not just numbers on a spreadsheet but a dynamic representation of a business’s potential.

When crafted with precision and presented effectively, these models instill confidence in investors, fostering a positive relationship between entrepreneurs and financiers.

Financial Modeling for Healthcare Startups

Financial modeling for healthcare startups involves creating a detailed representation of the company’s financial performance and projections. In the dynamic world of healthcare, innovation runs rampant.

From telemedicine apps to AI-powered diagnostics, startups are transforming how we deliver and experience healthcare.

But amidst the hustle and buzz, one element remains critical for success: a robust financial model.

For healthcare startups, financial modeling isn’t just about securing funding; it’s about building a roadmap for the future.

It’s understanding how your business will generate revenue, manage costs, and ultimately become profitable.

In a landscape marked by complex reimbursement mechanisms and evolving regulations, a well-constructed financial model becomes your guiding light.

Financial Modeling for Healthcare Startups Why is it Different for Healthcare?

Building a financial model for a healthcare startup presents unique challenges. Unlike traditional businesses, your revenue streams might involve a mix of patient payments, insurance reimbursements, and grants.

Moreover, the regulatory environment can be intricate, impacting everything from pricing to data privacy.

Here is a step-by-step guide to creating a financial model for a healthcare startup

- Market Analysis: Understand the size and growth potential of your target market. Identify key competitors and their pricing strategies.

- Revenue Model: Define how you’ll generate income. Will it be through subscriptions, per-service fees, or partnerships with healthcare providers?

- Cost Structure: Factor in operational costs like personnel, technology, and marketing. Don’t forget regulatory compliance expenses.

- Expense Projections:

Operating Expenses: Detail all operating costs, including salaries, rent, utilities, insurance, and other overhead expenses.

Capital Expenditures: Include any significant investments in assets like equipment or technology.

- Cash Flow Statement:

Cash Inflows: Consider all sources of cash, including investments, loans, and revenue.

Cash Outflows: Account for all expenses and investments that require cash.

- Balance Sheet:

Assets: List all the assets your startup owns, including cash, equipment, and intellectual property.

Liabilities: Include debts, loans, and other financial obligations.

- Financial Projections: Forecast future revenue, expenses, and cash flow. Be realistic, but not pessimistic. Remember, investors appreciate ambitious yet achievable goals.

- Sensitivity Analysis: Analyze how your model reacts to changes in key assumptions, such as market size or reimbursement rates. This helps you prepare for potential risks and opportunities.

- Valuation: Determine the valuation of your healthcare startup. This is crucial for fundraising and strategic decision-making.

- Risk Analysis: Identify potential risks and uncertainties impacting your financial projections. Develop strategies to mitigate these risks.

- Scenario Analysis: Model different scenarios to assess the impact of various market conditions on your startup’s financial health.

- Investor Presentation: Summarize your financial model in a clear and concise format suitable for investor presentations. Highlight key metrics and assumptions.

- Iterate and Update: Regularly update your financial model to reflect changes in the market, business strategy, or other relevant factors. This ensures that your projections remain accurate and useful.

Beyond the Numbers

Effective financial modeling for healthcare startups goes beyond mere spreadsheets. It’s about communicating your vision effectively.

Present your model clearly and concisely, highlighting key assumptions and potential scenarios.

Investors want to understand your thought process and see your passion for making a difference in healthcare.

Tools and Resources for Financial Modeling for Healthcare Startups

- Financial modeling software: Excel remains a popular choice, but specialized healthcare modeling tools can offer greater flexibility and accuracy.

- Industry reports and data: Research market trends, regulatory changes, and reimbursement rates. Reliable data strengthens your assumptions and adds credibility to your model.

- Mentors and advisors: Seek guidance from experienced healthcare professionals and financial experts. Their insights can be invaluable in navigating the complexities of the industry.

Remember: Your financial model is a living document. As your Financial Modeling for Healthcare Startups evolves, so should your model. Regularly update it with new data and adapt your assumptions to reflect changing market realities.

conclusion

In conclusion, building a robust Financial Modeling for Healthcare Startups is not just an obligation for healthcare startups; it’s an opportunity.

It’s a chance to showcase your potential, attract investors, and ultimately, achieve your vision of improving healthcare.

So, grab your spreadsheets, gather your data, and start building your roadmap to success.

The future of healthcare waits for no one, and a well-crafted Financial Modeling for Healthcare Startups will be your compass on the journey.

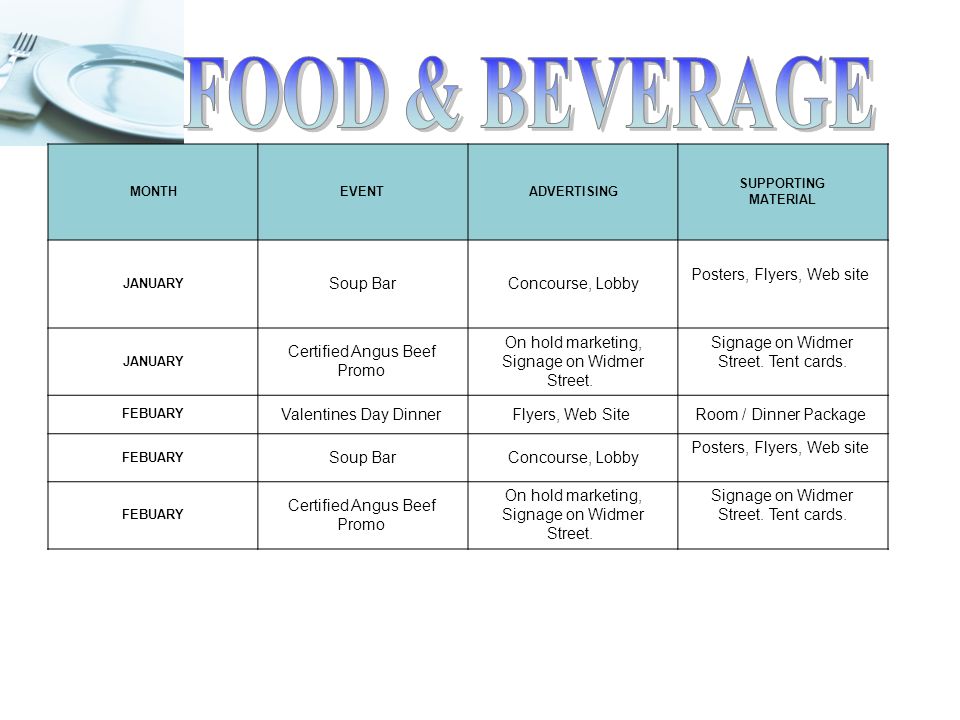

How do you write a business plan for food and beverage?

A well-written business plan for food and beverage is essential for any food and beverage business, whether you’re starting a new restaurant or expanding an existing one.

It will help you clarify your vision, identify potential challenges, and secure funding.

What is a business plan for food and beverage?

A business plan is a written document that outlines your business goals, strategies, and financial projections. It should be clear, concise, and persuasive.

What should be included in a business plan for food and beverage?

Your business plan should include the following sections.

Executive Summary

A brief overview of your business, including your concept, target market, and financial projections.

Company Description

A detailed description of your business, including your mission, values, and competitive advantage.

Market Analysis

An analysis of the food and beverage market, including your target market, competition, and industry trends.

Marketing Plan

How you will reach your target market and promote your business.

Operations Plan

How you will run your business, including your menu, staffing, and logistics.

Financial Projections

Your financial forecasts, including your revenue, expenses, and profit margin.

Management Team

A description of your management team and their experience.

Funding Request

If you are seeking funding, you will need to include a funding request in your business plan.

Tips for writing a business plan for food and beverage

Keep it concise: Your business plan should be no more than 20 pages long.

Use clear and concise language: Avoid using jargon or technical terms.

Focus on the financials: Make sure your financial projections are realistic and well-supported.

Get feedback: Ask friends, family, and mentors to review your business plan before you submit it.

Additional resources

The Small Business Administration (SBA) has several resources for food and beverage businesses, including a sample business plan template.

The SCORE organization provides free mentoring and business advice to entrepreneurs.

Writing a business plan can be a daunting task, but it is essential for any food and beverage business.

Conclusion

By following this guide and tailoring each section to your specific business, you’ll be well on your way to creating a comprehensive business plan for your food and beverage venture.

Remember to keep your plan clear, concise, and reflective of your passion for the culinary experience you aim to provide.

How to use financial modeling to make a social impact?

In this article, we’ll explore how to leverage financial modeling to make a social impact aligning financial strategies with positive change.

Financial modeling, often associated with corporate profits and Wall Street titans, can be a powerful tool for a different kind of ambition: making a social impact.

By harnessing the analytical power of numbers, individuals and organizations can design, evaluate, and scale initiatives that address pressing social and environmental challenges.

Why financial modeling to make a social impact?

Traditional impact assessment methods, while valuable, often lack the precision and clarity needed to attract investors, secure funding, and demonstrate real-world effectiveness.

Financial modeling provides a robust framework to

- Quantify the impact: Translate the qualitative goals of a social initiative into measurable metrics. This could be the number of lives improved, the amount of carbon emissions reduced, or the increase in educational attainment.

- Forecast outcomes: Predict the impact of different interventions and strategies, allowing for informed decision-making and resource allocation.

- Attract and manage funding: Secure grants and investments by demonstrating your social impact project’s financial viability and potential return on investment (ROI).

- Track progress and measure success: Monitor and evaluate the effectiveness of your initiative over time, allowing for course correction and continuous improvement.

Financial Modeling in Action

Here are some ways financial modeling can be applied to different areas of social impact:

- Microfinance: Modeling can assess the loan repayment capacity of low-income individuals and optimize loan terms to maximize both financial sustainability and social impact.

- Sustainable agriculture: Financial models can predict the economic feasibility of sustainable farming practices and quantify their environmental benefits.

- Education initiatives: Modeling can assess the cost-effectiveness of different educational programs and predict their impact on student outcomes.

- Renewable energy projects: Financial models can evaluate the financial viability of wind farms, solar installations, and other renewable energy projects, attracting investment and accelerating the transition to clean energy.

Building a financial modeling to make a social impact

- Define your goals and impact metrics: Clearly articulate your desired social outcome and identify measurable indicators to track progress.

- Gather relevant data: Collect historical, industry benchmarks, and impact-specific data to inform your model.

- Choose the right model: Select a financial model type (e.g., cost-benefit analysis, discounted cash flow) that aligns with your goals and data availability.

- Make realistic assumptions: Base your model on credible assumptions, acknowledging uncertainties and conducting sensitivity analyses to assess risk.

- Communicate effectively: Present your model in a clear and easy-to-understand manner, highlighting key findings and potential impact.

Beyond the Numbers

While financial modeling is a powerful tool, it’s important to remember that social impact goes beyond numbers.

Building relationships with stakeholders, understanding the local context, and adapting to changing circumstances are crucial for long-term success.

FAQs

How can financial modeling to make a social impact benefit social impact initiatives?

Financial modeling helps organizations plan, allocate resources, and measure the success of social impact projects, ensuring a more strategic and impactful approach.

What challenges do organizations face when implementing financial modeling to make a social impact?

Challenges include limited data availability, complex social dynamics, and external factors beyond an organization’s control. Overcoming these challenges requires adaptive strategies.

Are there specific tools recommended for financial modeling to make a social impact?

Yes, platforms like [Software A] and [Software B] offer features tailored to the unique needs of social impact initiatives, enhancing the efficiency of financial modeling.

How often should organizations update their financial modeling to make a social impact?

Regular updates are crucial to reflect changing circumstances, emerging trends, and evolving community needs.

Conclusion

Financial modeling is not just for Wall Street anymore. Individuals and organizations can create a more just and sustainable world by harnessing its power.

By quantifying the impact of their initiatives, attracting funding, and making informed decisions, social entrepreneurs can turn their passion into measurable change.

So, grab your spreadsheets, roll up your sleeves, and let’s use the language of numbers to speak the language of social good.

How To Create A Financial Model For A Green Tech Startup?

Starting a Financial Model For A Green Tech Startup is not just about innovative ideas and cutting-edge technology; it’s also about ensuring financial sustainability.

In the face of climate change and resource depletion, green tech startups are emerging as powerful solutions.

However, turning these innovative ideas into successful businesses requires a solid financial foundation.

A well-crafted financial model is a crucial tool for green tech startups to attract investors, secure funding, and navigate the path to profitability.

As the world pivots towards sustainable solutions, understanding the nuances of green tech becomes crucial for any startup.

To build a winning Financial Model For A Green Tech Startup

1. Define Your Revenue Model

How will your green tech solution generate revenue? Will it be through product sales, subscriptions, licensing fees, or a combination? Clearly define your revenue streams and forecast future sales based on market research, industry trends, and potential customer adoption.

2. Estimate Cost of Goods Sold (COGS)

Accurately estimate the costs associated with producing and delivering your green tech solution. This includes material costs, manufacturing expenses, and any additional costs specific to your product or service.

3. Project Operating Expenses

Identify and categorize all ongoing expenses associated with running your business, such as salaries, rent, utilities, marketing, and administrative costs. Ensure your projections are realistic and account for potential growth in your operations.

4. Consider Capital Expenditures (CAPEX)

If your green tech solution requires significant upfront investments in equipment, technology, or infrastructure, include these costs in your model. Consider depreciation and amortization schedules for these assets.

5. Plan for Financing

Outline your funding strategy, whether it involves bootstrapping, angel investors, venture capital, or other sources. Define the amount of capital required, potential terms of investment, and repayment plans.

6. Build Your Model

Choose a suitable platform like Excel, Google Sheets, or specialized financial modeling software. Organize your model into clear tabs for each financial statement (income statement, balance sheet, cash flow statement), and include relevant charts and graphs for visual representation.

7. Incorporate Flexibility

Your model should adapt to changing market conditions and unforeseen circumstances. Include sensitivity analyses to assess the impact of different assumptions on your financial projections.

8. Keep it Simple and Clear

While your model should be comprehensive, avoid unnecessary complexity. Prioritize clarity and transparency to allow investors and stakeholders to understand your financial forecasts and assumptions easily.

9. Regularly Review and Update

As your business evolves, so should your financial model. Regularly review and update your projections to reflect changes in your business plan, market dynamics, and financial performance.

10. Seek Expert Support

Consider seeking guidance from financial professionals or experienced advisors familiar with green tech funding and financial modeling. Our expertise can help refine our model and ensure its accuracy and effectiveness.

By following these steps and incorporating these key components, we can build a robust financial model to attract investors, secure funding, and propel our green tech startup toward a sustainable future. Remember, a well-built financial model is not just a static document; it’s a dynamic tool that allows us to assess our business’s potential, make informed decisions, and ultimately achieve success in the green tech landscape. If you want to know about the components of the financial model.

FAQs

What is the significance of a Financial Model For A Green Tech Startup?

Financial Model For A Green Tech Startup provides a roadmap for sustainable growth, balancing profit with environmental impact.

How can a Financial Model For A Green Tech Startup estimate its environmental impact?

Conduct an environmental impact assessment, calculating factors like carbon footprint and sustainable practices.

Are there specialized financial modeling tools for green tech?

Yes, there are tools designed to cater specifically to the unique needs of the Financial Model For A Green Tech Startup.

How do uncertainties in the green tech industry affect financial modeling?

Uncertainties require a flexible Financial Model For A Green Tech Startup, with contingency plans to adapt to changing circumstances.

Can financial models adapt to changing sustainability practices?

Regular updates and revisions ensure that financial models remain aligned with evolving sustainability practices.

Conclusion

Creating a financial model for a green tech startup is a meticulous yet rewarding process.

It’s not just about numbers; it’s about balancing financial success with environmental responsibility. Remember, a well-crafted financial model is a dynamic tool that evolves with your business.

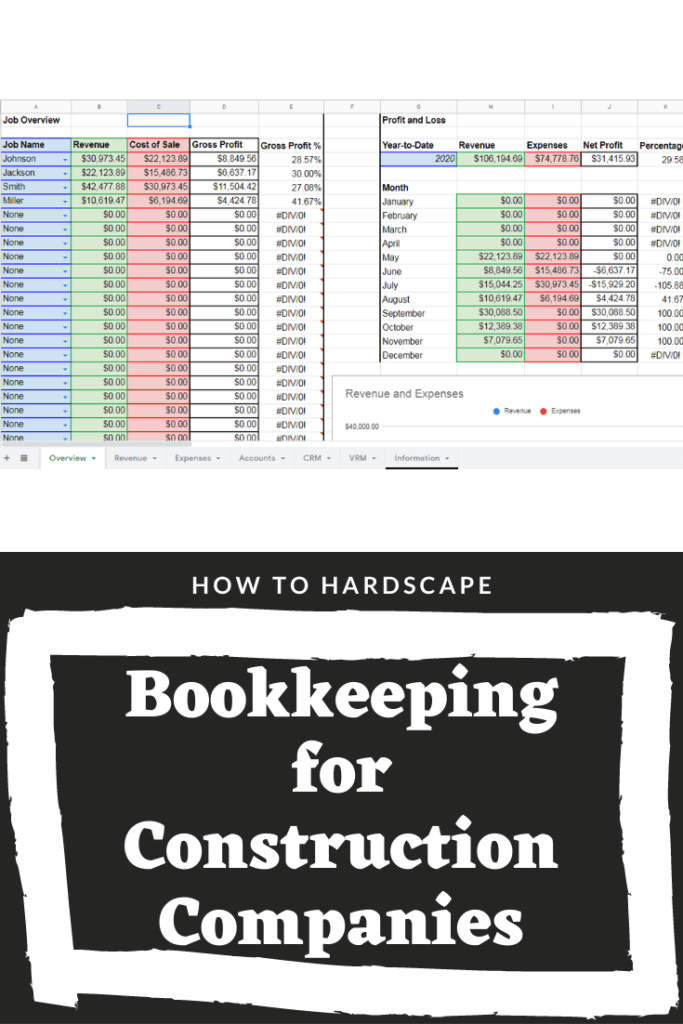

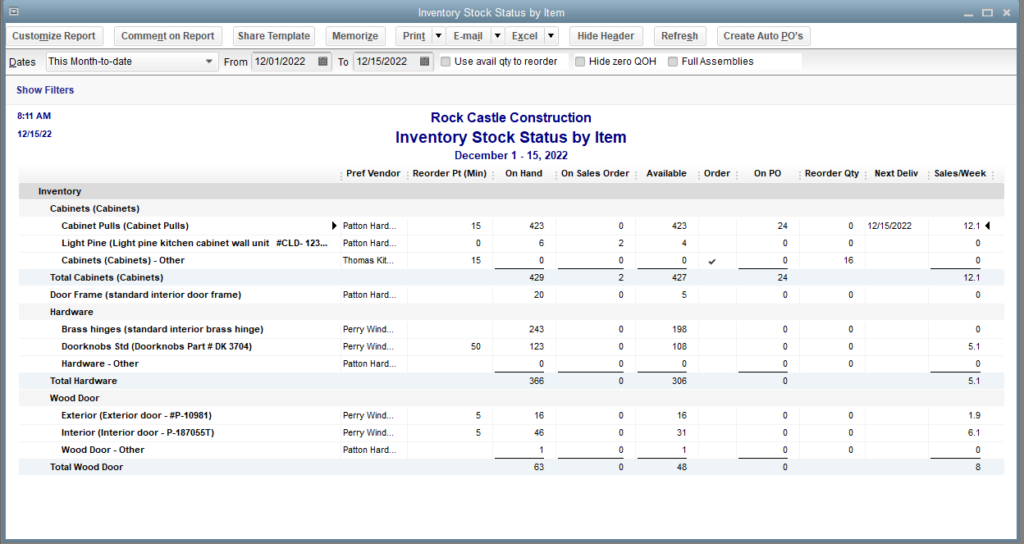

What is Bookkeeping in Construction?

Bookkeeping in Construction refers to the systematic recording, organizing, and managing of financial transactions and records within a construction company. It involves tracking and documenting income, expenses, assets, liabilities, and equity related to construction projects. By maintaining accurate financial records, construction companies can gain insights into their financial health, profitability, and project performance.

Importance of Bookkeeping in Construction

Effective bookkeeping is essential for construction companies due to the unique nature of the industry. Construction projects involve numerous financial transactions, including material purchases, subcontractor payments, equipment rentals, and labor costs. Proper bookkeeping ensures that all these transactions are recorded accurately, enabling companies to monitor costs, maintain cash flow, and comply with financial regulations.

Key Principles of Construction Bookkeeping

To maintain accurate and reliable financial records, Bookkeeping in Construction follows several key principles:

Accrual Accounting

Accrual accounting is widely used in Bookkeeping in Construction. It recognizes revenues and expenses when they are earned or incurred, regardless of when the cash is received or paid. This method provides a more accurate representation of a company’s financial position and performance.

Cost Tracking and Job Costing

Bookkeeping in Construction projects often has multiple cost elements. Effective bookkeeping involves tracking and allocating costs to specific projects or job sites. Job costing enables companies to monitor the profitability of individual projects and make informed decisions.

Separate Accounts for Each Project

To ensure proper project cost tracking and financial clarity, construction companies typically maintain separate accounts for each project. This segregation helps prevent the intermingling of funds and provides a clear overview of project-specific financials.

How do I choose the right bookkeeping software for my construction business?

To establish effective bookkeeping practices in the construction industry, consider the following best practices:

Regular Reconciliation

Perform regular bank reconciliations to ensure that financial records match with bank statements. This practice helps identify discrepancies and ensures accurate financial reporting.

Documenting and Categorizing Expenses

Maintain a well-organized system for documenting and categorizing expenses related to construction projects. This practice enables easy tracking of project costs and simplifies financial analysis.

Retaining Supporting Documentation

Keep all supporting documentation, such as invoices, receipts, and contracts, organized and easily accessible. These documents serve as evidence for transactions and provide necessary backup during audits or disputes.

Implementing Internal Controls

Establish robust internal controls to minimize the risk of fraud or errors. Segregate duties, implement approval processes, and regularly review financial records to maintain integrity and accuracy.

Do you need a bookkeeper for a construction business?

Selecting the appropriate bookkeeping software is vital for efficient construction bookkeeping. Look for software that offers features specifically designed for the construction industry, such as project tracking, job costing, and integration with other construction management systems.

What are the most common bookkeeping challenges faced by the Bookkeeping in Construction Industry?

Bookkeeping in the construction industry comes with its own set of challenges, including:

Tracking Costs Across Multiple Projects

Managing and tracking costs across multiple ongoing projects can be complex. Bookkeeping in Construction must provide accurate and detailed cost tracking to ensure project profitability.

Dealing with Change Orders and Variations

Bookkeeping in Construction projects often experiences change orders and variations that impact costs and revenue. Bookkeeping practices should account for these changes to maintain accurate financial records.

Managing Cash Flow

Cash flow management is critical in construction due to the timing of payments and expenses. Bookkeeping in Construction should focus on monitoring cash flow and ensuring sufficient funds for project operations.

What are the benefits of outsourcing Bookkeeping Services for Construction Companies?

Outsourcing bookkeeping services to specialized professionals can offer several advantages for construction companies, including:

Expertise and Industry Knowledge

Outsourced bookkeepers possess specialized knowledge of Bookkeeping in Construction practices and regulations, ensuring accurate and compliant financial reporting.

Time and Cost Savings

By outsourcing bookkeeping, construction companies can free up valuable time and resources, allowing them to focus on core business activities and reducing overhead costs.

Access to Advanced Technology

Outsourced bookkeeping services often utilize advanced accounting software and tools, providing construction companies with access to the latest technology without significant investments.

What accounting components affect the construction industry’s bookkeeping process?

Construction companies must comply with various financial regulations and reporting requirements. These may include tax obligations, labor regulations, and industry-specific regulations. Adhering to these regulations is essential for avoiding penalties and maintaining the company’s financial reputation.

Monitoring and Analyzing Financial Performance in Construction

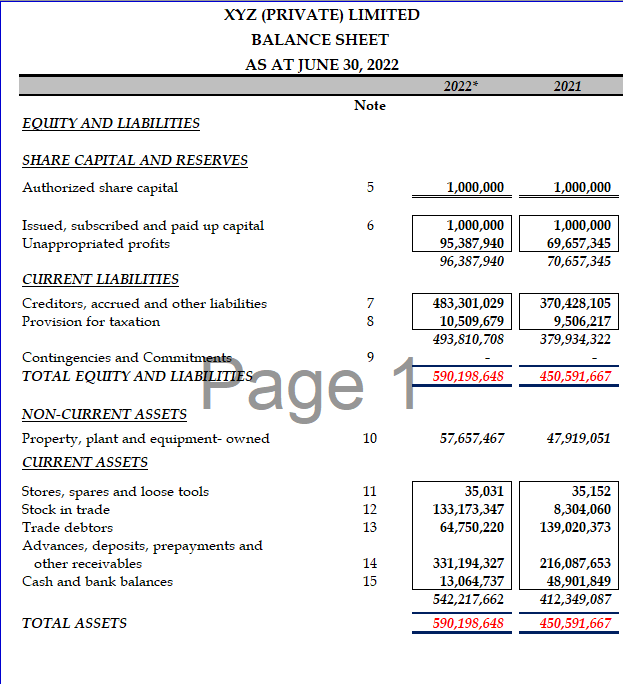

Bookkeeping in Construction facilitates monitoring and analyzing financial performance by generating financial reports, including income statements, balance sheets, and cash flow statements. These reports help construction companies assess their profitability, identify areas for improvement, and make informed financial decisions.

Integrating Bookkeeping with Project Management in Construction

Integrating bookkeeping with project management systems enhances efficiency and accuracy in the construction industry. By integrating project data with bookkeeping records, companies can better track costs, manage budgets, and ensure project profitability.

Why is cash flow management important in construction?

Cash flow management is vital for construction companies to ensure uninterrupted project operations. Effective bookkeeping practices help monitor cash inflows and outflows, enabling timely payment of expenses and maximizing revenue generation.

Tax Considerations for Construction Companies

Construction companies must navigate various tax considerations, such as income tax, sales tax, and payroll tax. Adhering to tax regulations, maintaining proper records, and working with tax professionals can help companies optimize their tax positions and minimize potential liabilities.

Bookkeeping Tools and Resources for Construction Professionals

Several bookkeeping tools and resources are available to assist construction professionals in their financial management efforts. These tools offer features like expense tracking, invoicing, and financial reporting, streamlining bookkeeping processes for construction companies.

Key Takeaways and Conclusion

Bookkeeping is a vital aspect of construction management, ensuring accurate financial recording, cost tracking, and compliance with regulations. By implementing sound bookkeeping practices and utilizing appropriate software and resources, construction companies can optimize their financial operations, make informed decisions, and achieve long-term success.

Why is bookkeeping important in the construction industry?

Bookkeeping in Construction is important in the construction industry to track expenses, manage cash flow, and ensure compliance with financial regulations. It helps construction companies maintain accurate financial records and make informed business decisions.

How does bookkeeping benefit construction companies?

Bookkeeping benefits construction companies by providing financial accuracy, cost tracking, and insights into project profitability. It helps companies manage their finances effectively and make informed decisions.

Can construction companies outsource their bookkeeping services?

Yes, construction companies can outsource their bookkeeping services to specialized professionals. Outsourcing offers expertise, cost savings, and access to advanced technology, allowing companies to focus on their core business activities.

What are the key challenges in construction bookkeeping?

Some key challenges in construction bookkeeping include tracking costs across multiple projects, managing change orders and variations, and effectively managing cash flow due to timing differences in payments and expenses.

How does bookkeeping integrate with project management in construction?

Integrating bookkeeping with project management systems enhances efficiency and accuracy in the construction industry. It allows for better cost tracking, budget management, and project profitability analysis.

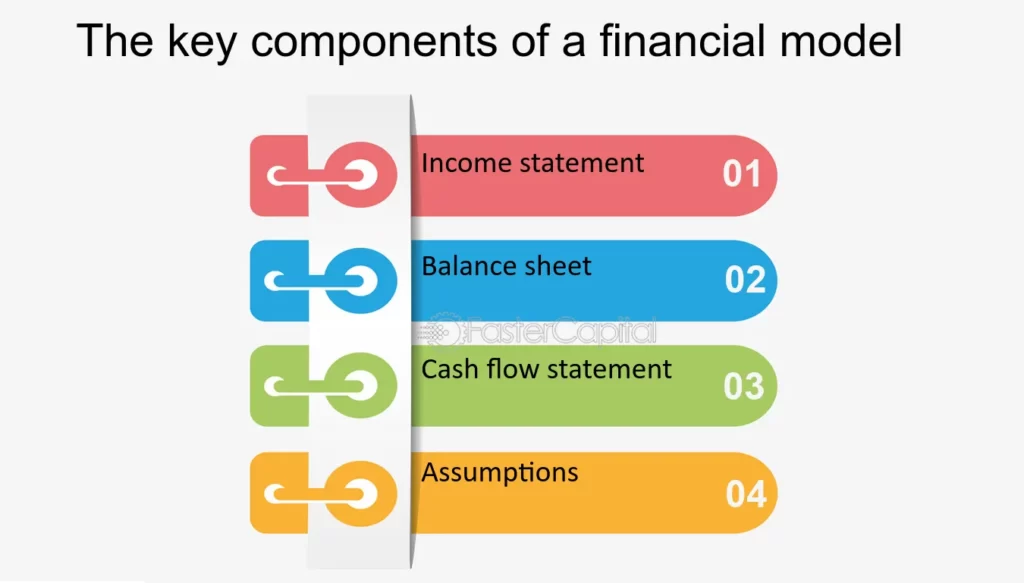

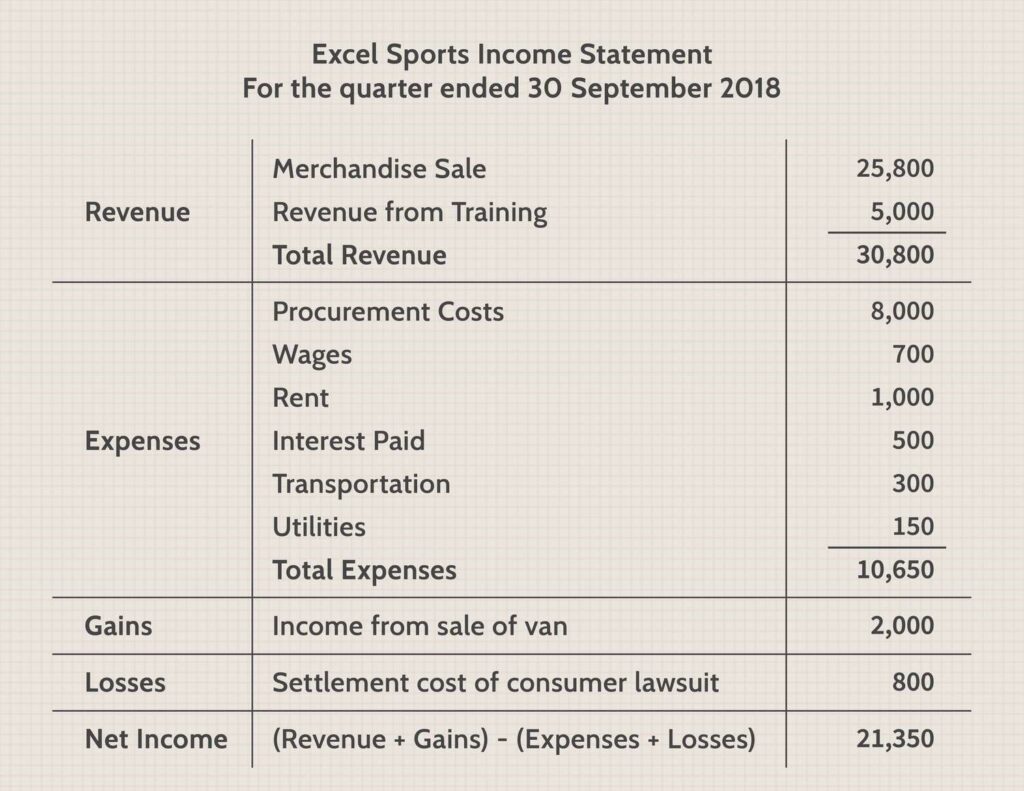

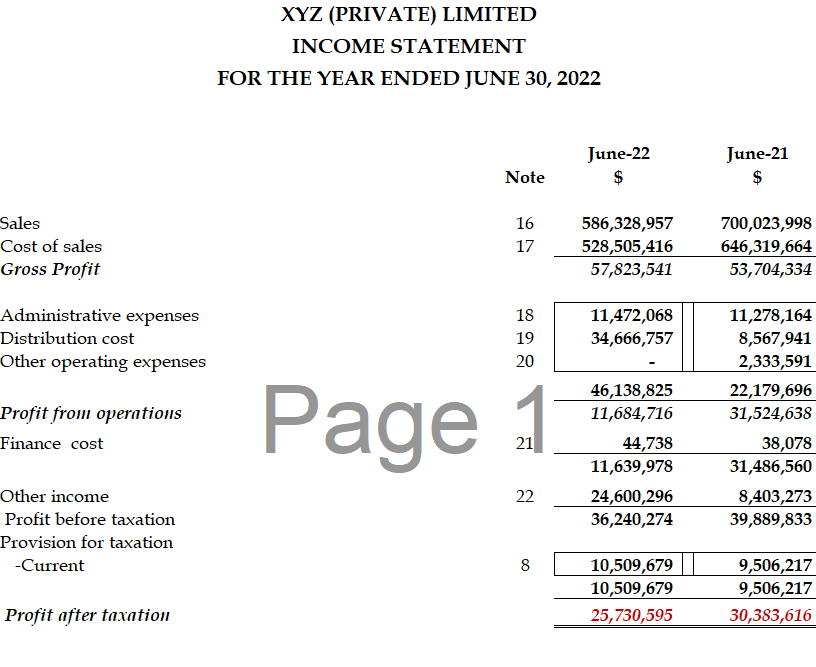

What are the 4 major components of financial modeling?

Whether you’re a business owner, an investor, or a financial analyst, understanding the four major components of financial modeling is essential for navigating the complex landscape of finance.

Financial modeling is a critical aspect of strategic decision-making for businesses and individuals alike.

In this article, we will delve into the key components of financial modeling that constitute effective financial modeling, providing insights into its purpose, building blocks, challenges, and real-world applications.

Financial modeling is a powerful tool used across various fields, from investment banking and corporate finance to business planning and entrepreneurship.

It allows users to project a company’s financial performance, assess risks, and make informed decisions.

But what are the core elements that make up a robust financial model?

Four major components of financial modeling

1. Income Statement

The income statement, also known as the profit and loss statement, provides a snapshot of a company’s financial health over a specific period.

It summarizes the revenues earned, expenses incurred, and ultimately, the net profit or loss generated. Key components of financial modeling include:

- Revenue: This represents the total income generated from selling goods or services.

- Cost of Goods Sold (COGS): This reflects the direct costs associated with producing the goods or services sold.

- Operating Expenses: These are indirect costs incurred in running the business, such as salaries, rent, and utilities.

- Taxes: This includes corporate income taxes and other applicable levies.

- Net Income: This is the final profit or loss after deducting all expenses from the revenue.

2. Balance Sheet

The balance sheet presents a company’s financial position at a specific point in time.

It captures the company’s assets, liabilities, and shareholders’ equity, providing a picture of its financial resources and obligations.

Key components of financial modeling include:

- Assets: This represents the resources owned by the company, including current assets (cash, inventory) and long-term assets (property, equipment).

- Liabilities: These are the company’s financial obligations, including current liabilities (accounts payable, accrued expenses) and long-term liabilities (loans, bonds).

- Shareholders’ Equity: This represents the residual ownership interest of shareholders, calculated by subtracting liabilities from assets.

3. Cash Flow Statement

The cash flow statement details the inflow and outflow of cash within a specific period. It helps assess the company’s liquidity and ability to meet its financial obligations.

Key components of financial modeling include:

- Operating Activities: This includes cash inflows from sales and outflows for expenses related to running the business.

- Investing Activities: This includes cash inflows from selling assets and outflows for purchasing new assets.

- Financing Activities: This includes cash inflows from raising debt or issuing equity and outflows for repaying debt or paying dividends.

4. Debt Schedule

The debt schedule details the company’s outstanding debt obligations, including the principal amount, interest rate, maturity date, and repayment schedule.

It helps understand the company’s financial risk and ability to manage its debt burden.

These four components of financial modeling are dynamically linked and interdependent. Changes in one component can affect the others, highlighting the interconnectedness of a company’s financial health.

By understanding and analyzing these components, financial models provide valuable insights for decision-making, investment analysis, and strategic planning.

FAQs

What is the significance of financial modeling in startups?

Financial modeling is particularly crucial for startups as it helps in forecasting and planning, aiding them in securing funding and making strategic decisions for sustainable growth.

How often should financial models be updated?

Financial models should be updated regularly, especially when there are significant changes in the business environment, to ensure accuracy and relevance.

Can artificial intelligence replace traditional financial modeling?

While AI can enhance financial modeling, it’s unlikely to replace traditional modeling entirely. Human expertise is still essential for interpreting results and making strategic decisions.

What are the common mistakes to avoid in financial modeling?

Common mistakes include overlooking data quality, neglecting to update assumptions, and failing to consider external factors. Rigorous attention to detail is crucial to avoid these pitfalls.

Are there any free resources for learning financial modeling?

Yes, there are several free resources available online, including tutorials, webinars, and open-access courses, making financial modeling accessible to a broader audience.

Conclusion

In conclusion, mastering the four major components of financial modeling is crucial for individuals and businesses seeking to make informed decisions.

The evolving landscape of finance demands continuous learning and adaptation to leverage the full potential of financial modeling.

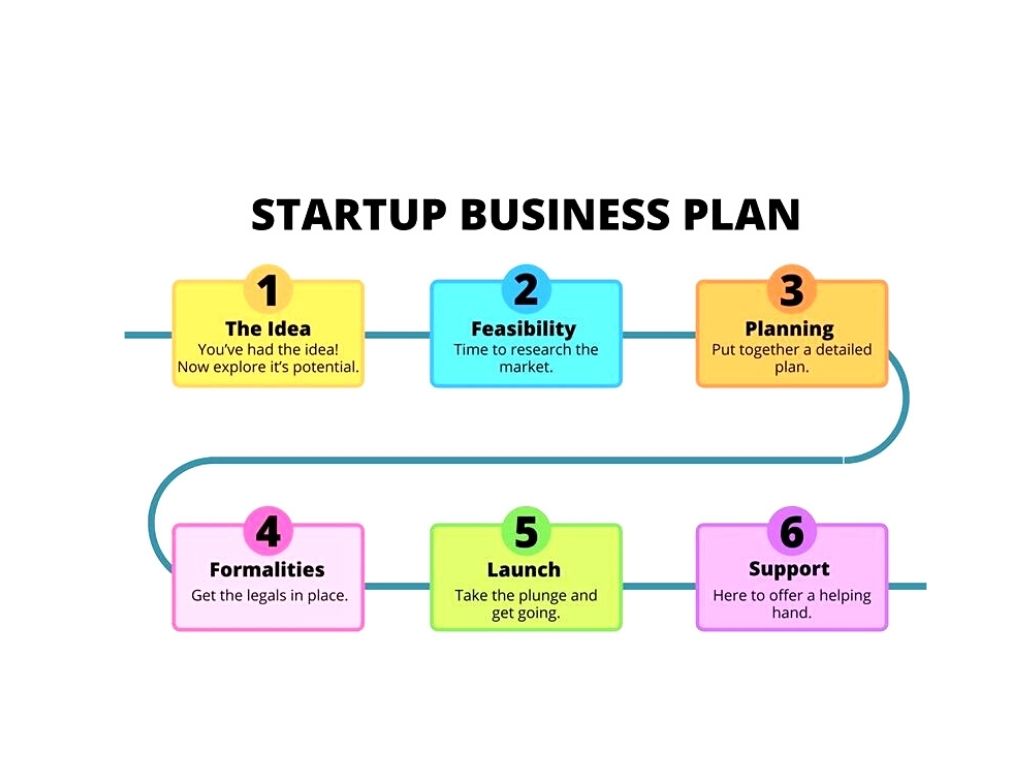

How to write a business plan for a startup?

A business plan for a startup is a roadmap for your startup, outlining your goals, strategies, and how you plan to achieve them. It’s an essential tool for attracting investors, securing funding, and keeping your business on track.

key steps to writing a business plan for a startup

1. Identify your target audience

- Who are you trying to reach with your product or service?

- What are their needs and wants?

2. Define your value proposition

- What makes your product or service unique?

- Why should people choose you over your competitors?

3. Conduct market research

- Who are your competitors?

- What are their strengths and weaknesses?

- What is the size of the market?

- What is the growth potential?

4. Develop your marketing and sales strategy

- How will you reach your target audience?

- How will you convert leads into customers?

- What is your pricing strategy?

5. Create your financial projections

- What are your revenue projections?

- What are your cost projections?

- How much funding do you need?

6. Write your executive summary

- This is a brief overview of your business plan.

- It should be concise and compelling.

7. Put it all together

- Your business plan for a startup should be well-organized and easy to read.

- Use visuals like charts and graphs to make your data more digestible.

8. Get feedback

- Share your business plan for a startup with friends, family, and mentors.

- Get their feedback and make sure you’re on the right track.

9. Update your business plan for a startup regularly.

- Your business plan is a living document.

- As your business grows, you must update it to reflect your changing goals and strategies.

Tips

- Keep it concise: Your business plan should be no more than 20-30 pages long.

- Use clear and concise language: Avoid jargon and technical terms.

- Be realistic: Don’t overestimate your revenue or underestimate your costs.

- Be passionate: Your business plan should reflect your enthusiasm for your business.

Conclusion

In conclusion, a well-crafted business plan is the foundation for a successful startup. It attracts investors and serves as a guiding document for internal decision-making. Take the time to create a comprehensive plan that communicates your vision and sets your business on a path to success.

FAQs

Do I need a business plan if I’m not seeking funding?

Yes, a business plan is essential for internal clarity and strategic direction, even if you’re not seeking external funding.

How often should I update my business plan?

Regularly revisit and update your business plan, especially when there are significant changes in your market or business model.

What should I include in the appendix?

Include supporting documents like market research, financial statements, and other relevant data that add depth to your plan.

How can I make my executive summary stand out?

Focus on key differentiators, achievements, and the unique value your startup brings to the market.

Is it necessary to hire a professional to write my business plan?

While professional help can be valuable, many entrepreneurs successfully write their plans using online resources

BEST BOOKKEEPING SOFTWARE

<h3>II. Criteria for evaluating bookkeeping software</h3> <h4>A. User-friendly interface and ease of use</h4> When it comes to choosing the best bookkeeping software for your business, one crucial aspect to consider is the user-friendliness of the interface. A user-friendly interface ensures that you and your team can navigate the software easily and efficiently. Look for software that offers intuitive features, a clean design, and well-organized menus. A clear and logical layout can save you valuable time and minimize the learning curve for you and your staff.

Additionally, consider the ease of use in terms of data input and retrieval. The software should provide a streamlined process for entering financial information, generating reports, and accessing specific data. Features such as drag-and-drop functionality, autofill options, and customizable dashboards can greatly enhance the overall user experience.<h4>B. Features and functionalities</h4> Bookkeeping software should offer a comprehensive set of features and functionalities to effectively manage your financial records. Look for key features such as general ledger management, invoicing and billing, expense tracking, bank reconciliation, and financial reporting. These features will help you track income and expenses, reconcile accounts, and generate reports that provide valuable insights into your business’s financial health.

Furthermore, consider additional features that can streamline your bookkeeping processes. For example, integration with other business tools such as payroll software or CRM systems can facilitate data transfer and reduce manual entry. Automated features like recurring transactions, scheduled reporting, and data backup can save you time and ensure the accuracy and security of your financial data.<h4>C. Integration with other business tools</h4> Efficient bookkeeping often relies on the seamless integration of various business tools. When evaluating bookkeeping software options, consider how well they integrate with other software applications you use, such as payment processors, inventory management systems, or tax software.

Integration capabilities can streamline workflows and minimize duplicate data entry. For example, bookkeeping software that integrates with your e-commerce platform can automatically import sales data and update your financial records. This not only saves time but also reduces the risk of errors associated with manual data entry.

Before making a decision, research the available integrations for each bookkeeping software option you are considering. Check if they offer pre-built integrations or have an open API that allows for custom integrations. The more seamless the integration possibilities, the more efficient and effective your overall business operations will be.<h4>D. Security and data protection</h4> As bookkeeping involves handling sensitive financial information, security and data protection should be top priorities. When evaluating bookkeeping software, consider the security measures in place to protect your data from unauthorized access, loss, or corruption.

Look for software that offers encryption protocols, secure data storage, and regular backups. Additionally, check if the software adheres to industry standards and regulations, such as PCI DSS (Payment Card Industry Data Security Standard) compliance for handling credit card information.

Read reviews and testimonials from other users to gauge their experiences with the software’s security features. Pay attention to any incidents or breaches reported and how the software provider responded to them. Remember, robust security measures are crucial to safeguarding your business’s financial data and maintaining the trust of your clients and stakeholders.<h4>E. Pricing and affordability</h4> Pricing is an essential factor to consider when choosing the best bookkeeping software for your business. Take the time to understand the pricing structure of each software option and evaluate it in relation to your budget and needs.

Some software providers offer tiered pricing plans based on the number of users or the level of functionality required. Determine whether the pricing aligns with your business size and growth projections. It’s important to find a balance between affordability and the features and capabilities that are critical for your business

operations.

Consider not only the initial cost but also any additional fees or hidden charges that may be associated with the software. For example, some software providers may charge extra for customer support or for accessing advanced features. Take these factors into account when evaluating the overall affordability of the software.

Furthermore, consider the scalability of the pricing plans. As your business grows, you may need to upgrade to a higher-tier plan or add more users. Ensure that the software offers flexible pricing options that can accommodate your future needs without breaking the bank.

It’s also worth exploring if the software provider offers a free trial or a money-back guarantee. This allows you to test the software firsthand and assess its suitability for your business before making a financial commitment.

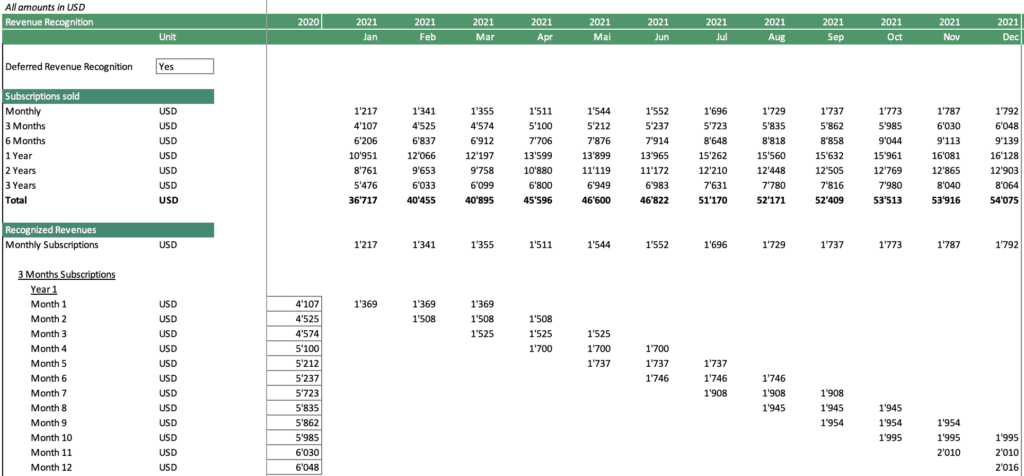

What is the SaaS 3 statement financial model?

This article delves into the intricacies of the SaaS 3 statement financial model unraveling its components and illuminating its significance in shaping strategic decisions.

In the dynamic world of Software as a Service (SaaS), financial modeling plays a pivotal role in steering businesses towards success.

Among the array of financial tools, the SaaS 3 statement financial model stands out as a comprehensive framework for evaluating and projecting a SaaS company’s financial health.

The Three Statements Model

The SaaS 3 statement financial model encompasses three fundamental financial statements that collectively portray a holistic picture of a SaaS company’s financial performance:

- Income Statement: This statement serves as a scorecard for a company’s operational performance, revealing its ability to generate revenue and manage expenses over a specified period. It depicts the company’s profitability or losses, providing insights into its core business activities.

- Balance Sheet: This statement serves as a snapshot of a company’s financial position at a particular point in time. It captures the company’s assets, liabilities, and equity, providing a glimpse into its financial resources and obligations.

- Cash Flow Statement: This statement bridges the gap between the income and balance sheets, demonstrating how cash flows in and out of the company over a designated period. It tracks the cash movement, highlighting the company’s ability to generate cash from its operations.

Model to the Industry

While the SaaS 3 statement financial model forms a universal framework for financial analysis, SaaS companies face unique characteristics that necessitate adaptations to the model.

- Recurring Revenue Model: SaaS businesses typically operate on a subscription-based model, earning recurring revenue from customer contracts. This model necessitates adjustments to revenue recognition and subscription metrics.

- Customer Acquisition Costs (CAC): CAC represents the expense of acquiring new customers, a crucial metric for SaaS companies. Incorporating CAC into the model helps assess the effectiveness of customer acquisition strategies.

- Customer Lifetime Value (CLTV): CLTV represents the total revenue a company expects to generate from a customer over their lifetime. Modeling CLTV provides insights into customer profitability and retention.

Strategic Decisions for SaaS 3 statement financial model

The SaaS 3 statement financial model serves as an invaluable tool for strategic decision-making, empowering businesses to:

- Project Financial Performance: The model allows businesses to forecast future revenue, expenses, and cash flows, enabling informed financial planning and investment decisions.

- Assess Profitability: By analyzing metrics like gross margin, EBITDA, and net income, businesses can gauge their profitability and identify areas for improvement.

- Evaluate Capital Structure: The model provides insights into the company’s debt and equity financing, aiding in optimizing capital structure and managing financial risks.

- Monitor Financial Health: Continuous monitoring of key financial ratios, such as quick and debt-to-equity ratios, helps identify potential financial issues and promptly take corrective measures.

How do you do financial modeling for a fintech startup?

In this article, we’ll delve into the intricacies of financial modeling for fintech startups, offering insights and strategies to help you build a solid foundation for your business.

Financial modeling is the backbone of strategic decision-making for any business, and in the dynamic world of fintech startups, it becomes even more critical.

Financial modeling for a fintech startup involves developing a framework to assess the financial viability and potential growth of the business.

It serves as a tool for entrepreneurs to make informed decisions, secure funding, and communicate their plans to investors. Here’s a step-by-step guide to financial modeling for a fintech startup:

1. Define Clear Objectives and Assumptions

- Objectives: Clearly outline the purpose of the financial model, whether it’s for fundraising, internal planning, or evaluating new business opportunities.

- Assumptions: Identify and document all key assumptions underlying the financial projections, such as market growth rates, customer acquisition costs, and revenue streams.

2. Understand the Fintech Business Model for a Fintech startup

- Revenue Streams: Analyze the various sources of revenue, such as transaction fees, subscription charges, or interest income.

- Cost Structure: Break down the operational expenses, including salaries, marketing costs, technology infrastructure, and regulatory compliance.

- Key Performance Indicators (KPIs): Determine the relevant KPIs for the fintech business, such as customer acquisition cost (CAC), lifetime value (LTV), and gross margin.

3. Develop Financial Statements

- Income Statement: Project the revenue, expenses, and profit or loss for each period, typically monthly or annually.

- Balance Sheet: Forecast the assets, liabilities, and equity of the company at each financial reporting date.

- Cash Flow Statement: Model the inflows and outflows of cash, including operating cash flow, investing cash flow, and financing cash flow.

4. Sensitivity Analysis and Scenario Planning

- Sensitivity Analysis: Test the impact of changing key assumptions on the financial projections to assess the model’s robustness.

- Scenario Planning: Develop different scenarios, such as optimistic, pessimistic, and most likely, to consider the range of potential outcomes.

5. Visualize and Communicate Findings

- Charts and Graphs: Create clear and concise charts and graphs to present the financial projections and insights.

- Executive Summary: Prepare a concise executive summary that highlights the key financial findings and implications for the business.

6. Continuously Refine and Update

- Regular Review: Regularly review and update the financial model as market conditions, business strategies, or assumptions change.

- Adaptability: Ensure the financial model can adapt to new business lines, products, or partnerships as the fintech startup evolves.

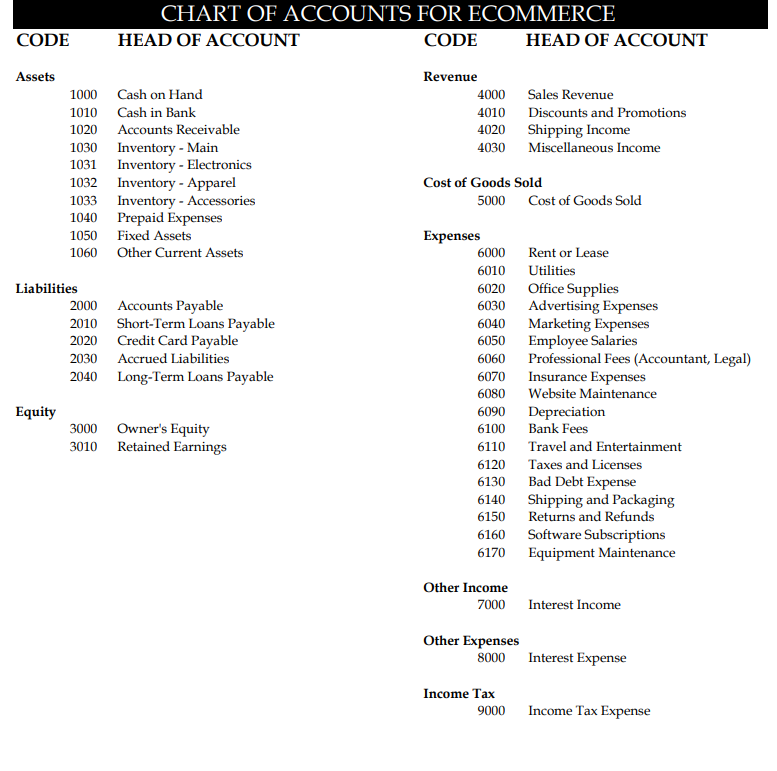

How to do financial modeling for an e-commerce startup?

Financial modeling for an e-commerce startup involves creating a detailed representation of the business’s financial performance, projections, and potential outcomes.

Financial modeling is the process of creating a financial forecast for a company.

This can be done for a variety of purposes, such as raising capital, making investment decisions, or planning for the future.

Financial models are typically created using spreadsheets, such as Microsoft Excel or Google Sheets.

To create a financial model for an e-commerce startup, you will need to gather a lot of information about the company, including:

- The company’s products or services

- The company’s target market

- The company’s pricing strategy

- The company’s marketing and sales plan

- The company’s operational costs

- The company’s financial statements

Once you have gathered this information, you can start to build your financial model. The first step is to create a revenue forecast. This will involve estimating how many sales the company will make each year. You will need to consider factors such as the company’s target market, its pricing strategy, and its marketing and sales plan.

The next step is to create an expense forecast. This will involve estimating all of the company’s costs, such as its cost of goods sold, its marketing and sales expenses, and its administrative expenses.

Customer Acquisition Costs (CAC): Estimate the cost of acquiring each customer through marketing and advertising.

Consider various channels such as social media, search engine marketing, and partnerships.

Customer Retention: Project customer churn rates (the rate at which customers stop buying from you).

Consider strategies for customer retention and repeat business.

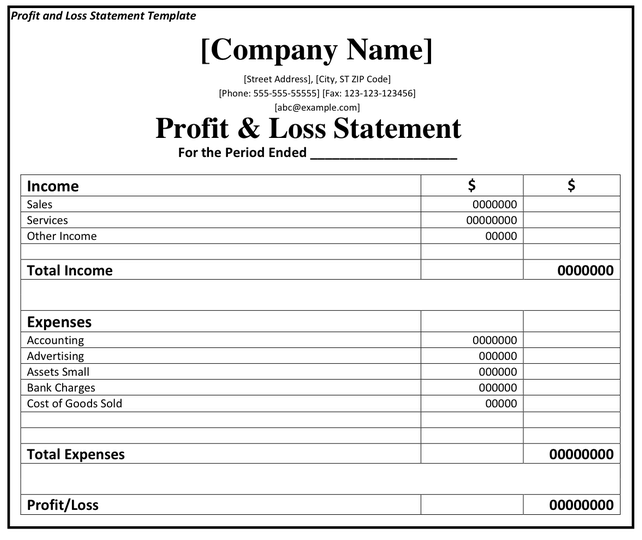

Once you have created a revenue forecast and an expense forecast, you can create a profit and loss statement. This is a financial statement that summarizes the company’s revenues, expenses, and profit or loss.

Operating Expenses: Identify and estimate fixed and variable operating expenses.

Include costs for marketing, employee salaries, technology, and any other relevant expenses.

The next step is to create a cash flow statement. This is a financial statement that shows how cash flows into and out of the company. This is important for e-commerce startups, as they often need to manage their cash flow carefully.

Funding Requirements: Determine how much funding you’ll need to start and run the business until it becomes profitable.

Consider different funding sources such as equity investment, loans, or grants.

Scenario Analysis: Perform sensitivity analysis and scenario planning to understand how changes in key variables affect your financials.

Consider best-case and worst-case scenarios to assess the business’s resilience.

Use Financial Models and Tools: Leverage spreadsheet software like Microsoft Excel or financial modeling tools to create detailed financial models.

Utilize templates or build models from scratch, depending on your proficiency.

Investor Presentation: Summarize your financial projections and key assumptions for potential investors.

Clearly communicate your business model, growth strategy, and financial milestones.

Regularly Update the Model: Periodically update your financial model to reflect actual performance and adjust assumptions as needed.

Use real data to refine your projections and improve the accuracy of your financial model.

The final step is to create a balance sheet. This is a financial statement that shows the company’s assets, liabilities, and equity. This is important for e-commerce startups, as it can help them to identify potential financial risks.

Financial modeling is a complex process, and it is important to get professional help if you are not familiar with it.

However, it can be a very valuable tool for e-commerce startups, as it can help them make informed decisions about their finances.

Here are some of the benefits of financial modeling for e-commerce startups:

- It can help you to identify potential financial risks.

- It can help you to make informed decisions about your pricing strategy.

- It can help you to make informed decisions about your marketing and sales plan.

- It can help you to make informed decisions about your staffing levels.

- It can help you to raise capital.

If you are an e-commerce startup, I encourage you to learn more about financial modeling. It can be a very valuable tool for helping you to achieve your business goals.

What are the assumptions of the SaaS financial model?

SaaS financial models are forecasting tools that software companies use to project future financial performance.

They are based on historical business performance, market dynamics, and assumptions about future growth.

These assumptions are crucial for understanding the potential financial viability of a SaaS company and for making informed business decisions.

Here are some of the key assumptions that are typically included in a SaaS financial model:

- Customer Acquisition Cost (CAC): The amount of money it costs to acquire a new customer. This includes the costs of marketing, sales, and customer support.

- Customer Lifetime Value (LTV): The total amount of revenue that a customer is expected to generate over their lifetime. This is typically calculated based on the average monthly recurring revenue (MRR) and the average customer churn rate.

- Churn Rate: The percentage of customers who cancel their subscriptions in a given period. This is a critical metric for SaaS companies, as it directly impacts their revenue and profitability.

- Monthly Recurring Revenue (MRR): MRR is the predictable and recurring revenue generated by subscriptions on a monthly basis. It assumes that customers will continue to pay their subscriptions regularly.

- Gross Margin: The percentage of revenue that remains after the direct costs of goods sold (COGS) have been subtracted. This metric is an indicator of the company’s ability to generate profit from its products or services.

- Average Revenue Per User (ARPU): ARPU is the average revenue generated per user or customer. It’s important to estimate how much revenue, on average, each customer contributes to the overall business.